Contents

What is Jar?

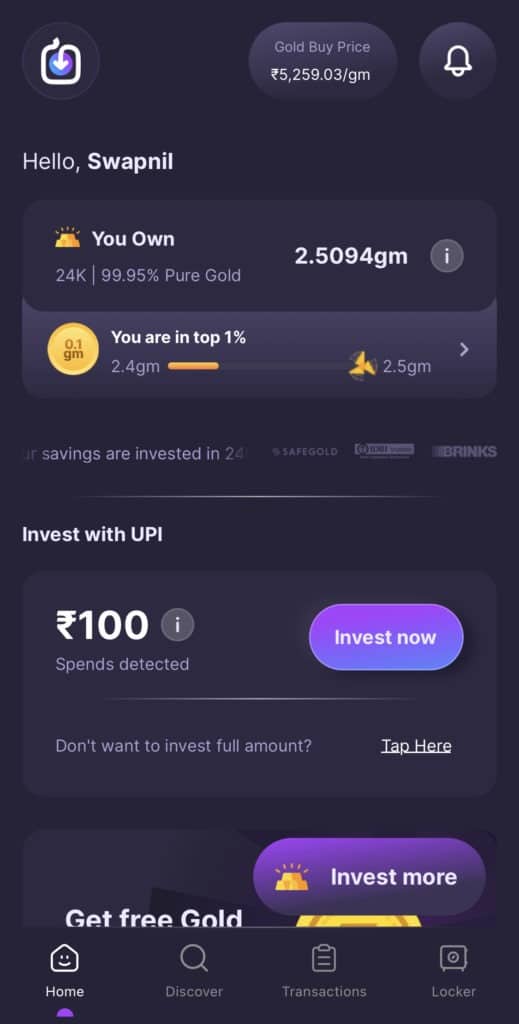

Jar is an app on Google play store(Android) and App store(iOS) through which users can invest in digital gold online. Jar is a daily gold savings app that makes saving money a fun habit by saving a small amount of money every time you spend online.

Jar App is like a digital Piggy Bank. It detects your expenses from the SMS folder in your mobile phone and Rounds it off to the nearest 10 to generate a spare change for each of your expenses. For example if you have done a mobile recharge for 98Rs online, Jar app will detect the recharge confirmation message in your SMS folder and rounds off to the nearest 10 i.e. 100Rs and take that spare change of 2Rs(100-98) from your bank account(Attached to your UPI Id) and automatically invests in Digital Gold.

What are some of the key features of the app?

Below are some of the top features of this app that I like:

- Allows users to invest as little as Rs.10 to buy digital gold

- Daily auto invest can be setup easily through UPI or bank mandate

- It auto detects the daily spends of the user and gives a prompt to invest the same amount into gold

- On every purchase, user is rewarded with free spins. On spinning the user can win any amount from Rs.1-Rs.8 which can then be further invested into gold(once total reaches Rs.100)

- Encourages users to save a small amount daily and invest it into gold

- You can sell your anytime you want and withdraw your money to your bank account from you home itself. There is no minimum lock in period

- Unlike physical gold, you don’t have to worry about theft or expensive locker fees. You gold is stored in bank-grade world class lockers free of cost.

Where is the savings invested?

Jar App automatically invests your spare change in 99.9% Pure Gold, which is fully secured in world-class vaults and insured by Top banks of India.

What is digital gold?

Digital gold is real gold that’s simply stored virtually to save space, provide safety, and buy or convert into physical gold conveniently with the click of a button.

When can you withdraw savings?

You can withdraw your money after 24 hours of investment. There is no minimum lock in period.

What are the different ways I can withdraw my savings?

User can withdraw the savings by selling the gold invested. The withdrawal can be done in either of the below ways:

- Gold delivery(minimum gold balance required is 0.5 gm): You can convert your Jar gold to physical gold anytime you want and get it delivered to your home through Jar’s partners.

- Cash in bank: Sell gold at the current sell price and get cash deposited in your bank account instantly.

How can you download the app?

Jar is available on both Android and iOS mobile devices. Simply type ‘Jar’ in the search bar to find & install the app in under two minutes.

Is it mandatory to do KYC to invest in gold in Jar?

Yes, it is mandatory to do KYC verification on Jar if:

– You have bought gold for more than 30 grams or INR 1.5 Lakhs.

– You want to sell gold and withdraw your money.

– You want to transfer Jar Winnings to purchase gold.

– You want to get gold delivered to your doorstep.

Who can invest?

Any Indian citizen over the age of 18 that banks with a SEBI-recognized bank may invest with Jar.

How to setup daily savings/auto pay?

To set up Daily Savings: On the app homescreen, click on the ‘Daily amount’ card and set the amount you wish to invest daily. You can choose to invest from Rs. 20 to Rs. 2000, which will be deducted daily from your bank account and invested in Digital Gold.

If you wish to edit your daily savings amount at some point, click on Locker and then on the ‘Daily amount’ card. Once this card opens, enter the new amount of your choice.

To set up Auto-Pay: Setting up Autopay on Jar is a very quick and easy process. Follow these steps to setup your Autopay within 1 minute on Jar.

1. Click on the Autopay card on your home screen.

2. Verify the subscription details.

3. Click on Setup Autopay.

4. Enter your UPI PIN and make the payment. Once the payment is successful, your Autopay on Jar is setup.

Alternatively, if you are not able to find the autopay card on your home screen, follow these steps:

Click on Locker -> Settings -> Autopay.

Click on Setup Autopay and follow the above steps.

What are the different avenues of saving apart from round offs?

Apart from Round offs, you have the option for ‘Daily Savings’ and to invest in Digital Gold ‘Manually’.

Daily Savings: You can set a fixed amount from Rs. 20 to Rs. 2000 with the auto pay feature to be deducted from your account and invest in Digital Gold everyday.

Invest Manually: To purchase gold manually, click on the ‘Invest More’ button on the Jar home screen, enter the amount of gold you wish to purchase, and make the payment. Once the payment is successful, gold will be added to your Jar locker.

Is Jar safe to use?

Jar app is 100% safe and secure to use for your Daily Savings & Investments in Gold. It is powered by SafeGold and all payments happen over secure banking networks.

All you need to do for every transaction is enter your PIN (which only you know), except the recurring daily mandates. UPI Autopay feature is a Safe & Secure process for recurring payments, once you authenticate the app, the round-offs will be auto-debited from the Bank Account linked with the UPI ID.

The services offered by the Jar app are offered by SafeGold as a provider. The gold you buy is backed by the RBI-regulated trustee—IDBI. That makes the investments through the Jar app quite safer. Your savings will remain yours forever. You have full control of your finances – pause, re-start or withdraw funds or gold easily with a click of a button.