Contents

Let us further discuss some of the top 68 – best credit cards in India 2019-2020. Here we are going to compare different credit cards with their salient features and present you the best credit card reviews so that you are not misguided by any agent or any scheme master.

Standard Chartered Platinum Rewards Card

- As a welcome gift, you get INR 250 bookmyshow voucher.

- Here you get 1000 reward points when doing any transaction within 60 days. Also 500 reward points for online banking registering.

- You also earn 5 reward points when spending INR 150 or more on fuel bills, hotel, and restaurant bills.

- You get 1 reward point for INR 150 spending on all other categories.

- Existing offer is that you get 20% cashback on Uber rides as well with this top credit card.

After filling the form with correct information, you will get a call from Standard Chartered representative to clear all your doubts and he will explain to you in case any new facilities have been added to the card.

Read more: New NEFT and RTGS timings of banks

Citibank Cashback Credit Cards

- You can earn 5% cashback for your utility bills. Like: electricity bills, mobile bills, etc.

- You get 5% cashback on booking movie tickets online.

- You also get 0.5% cash back for all other payments through this credit card.

For further clarification on this credit card, you can contact the customer care department of the bank.

Standard Chartered Super Value Titanium Credit Cards

- When doing payment through this card you get 5% cashback on fuels, phone bills, utility bills, etc.

- You also get 1,000 Bonus Reward Points when doing transactions within the initial 60 days for the card. Also 500 reward points as a bonus on online banking registering.

If you are spending more than INR 5000 per month (i.e.. INR 5000 * 12 = INR 60,000 per year) through this card then only I would suggest you go for this card to get maximum benefits from it.

ICICI Instant Platinum Card

- You get INR 100 off twice a month on movie tickets. Also, you get 3 payback points on every INR 100 spend.

- You also earn 15% off at 800 leading restaurants in India. Please check the list of restaurants with the bank where this offer is applicable.

- Your fuel surcharge is also been waived off when you spend more than INR 399 on fuel bills.

You can apply for credit card and discuss with ICICI bank representative for further clarification.

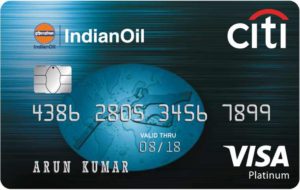

IndianOil Citi Platinum Credit Card

- You get 4 turbo points for every fuel transaction of INR 150 (1 Turbo Point equals INR 1.). Along with fuel surcharge waived off. With the total earnings of turbo point per price of 1-liter petrol, you can get up to 71 liters of petrol free per year.

- You earn 2 turbo points on transaction of INR 150 spent at departmental stores and groceries.

- You also earn 1 Turbo Point on every INR 150 spending on Dining / Shopping and much more.

Once you fill the form, the process will become easier. Citi bank representative will give you a call back with full details on it. Then you can think to buy credit card or compare for other credit cards in India.

Read more: 8 easy steps to start investing in mutual funds

Standard Chartered Manhattan Credit Card

If you are looking forward to the best credit card in India for shopping/grocery purchase/dining out /cashback/reward points then Standard Chartered Manhattan Credit Card is the best of all. Before writing this article we have taken the survey with our subscribers and found that out of 3 there is 1 who is holding Standard Chartered Manhattan Credit Card. This is the best credit card in India 2019 for salaried person. Check it out!

Customer Rating: 4.5 out of 5

Annual Fee: For the first year is Rs. 499 then from the second year is Rs. 999 only. But the fee can be waived off if you use the credit card for more than Rs. 30,000.

Key Benefits:

- This is the only credit card which is giving you 5% cashback on purchase of groceries from Departmental Stores / Super Market. For example Big Bazaar, More, Reliance Fresh, etc.

- You also get 5x Rewards points when paying for fuel bills, hotel/restaurant bills, airline tickets, etc. from this credit card.

- You can also get a maximum of Rs. 500 every month as cashback when spending through Standard Chartered Manhattan Credit Card which is again one of the best features I liked the most.

For any further queries, please fill the form. The representative will call you to clear all your doubts.

RBL Bank Titanium Delight Card

This is also one of the other top best credit cards for shopping in India. RBL Bank is a scheduled commercial bank started in 1943, headquartered in the Mumbai, India.

Customer Rating: 4.5 out of 5

Annual Fees: INR 750/- (From the second year onwards, annual fees can be waived off of minimum spending of INR 1,00,000 per year.)

Key Benefits:

- You earn a welcome gift voucher of 2000 reward points on 1st transaction within 30 days.

- Along with welcome voucher, you earn 1000 additional reward points on spending a minimum of INR 10,000 within 60 days of the card issued.

- You get 1 reward point for spending INR 100 on all transactions. (For example groceries, travel, dining, electricity bill, etc.)

- You earn 4000 as a bonus reward points for spending INR 1,20,000/- minimum in a year.

- You can earn 1+1 free movie ticket once a month on a Wednesday when booking from BookMyShow website.

- When you do the transaction on groceries on Wednesdays, you get 5% cashback as reward points.

- You get 10% cashback every Wednesday from Domino’s / Pizza Hut online on pizza orders.

- The fuel surcharge is been waived off with Titanium Delight Credit Card.

Once you fill all the details and apply online, you will get a call back from RBL bank representative explaining in detail about card along with additional offers.

Citibank Rewards Credit Cards

This is a good option for those people who are looking for the best credit card in India for reward points. You can easily redeem your reward points with exciting offers, gift vouchers and more.

Customer Rating: Product – Customer – Rating 4.5 – Review 4.5 – Wikipedia of Finance (4.5 out of 5 Rating.)

Annual Fees: Nil.

Key Benefits:

- You get 10x reward points on every INR 125 spending on departmental stores and apparels.

- You also earn 1x reward point on every INR 125 for all other purchases.

- This is an International Credit Card where you get benefits on spending in India as well as globally.

Once you fill the form, you can then get in touch with Citibank representative for further offers and clarification.

Elite SBI Credit Cards

Elite SBI Card is one of the best credit cards for lounge access and shopping by people. It is the one from the top 10 – credit cards in India. With this card, you get credit card fraud liability cover of INR 1 lakh as complimentary. All the daily purchases become easy with this card along with reward points on every transaction.

Customer Rating: 4.5 out of 5

Annual Fees: INR 4,999/- (Add-on Fees: NIL)

Key Benefits:

- From SBI you get a welcome Gift Voucher worth INR 5,000 (You can select from various lifestyle brands and travel partners like Hush Puppies/Bata, Yatra, MakeMyTrip, Marks & Spencer, Pantaloons, Shoppers Stop, etc.)

- Along with this SBI Elite Credit Card, you get free membership for Club Vistara, Trident Privilege, International Airport Lounge and more.

- You get 5X as reward points on spending on Departmental stores, Grocery, and Dining.

- You also earn 2 Points on spending INR 100 each at all other transactions.

- Get movie tickets free of INR 6,000 every year (valid for at least 2 tickets per booking and maximum of INR 250 per ticket discount on it. Convenience Fee would be chargeable.)

- Eligible to earn 10,000 bonus points on your annual spends of more than INR 3 Lakhs.

- Enjoy 2 complimentary Domestic Airport Lounge visits free for every quarter in India.

You can get more details and the latest offers from the representative. Once you fill the form by applying online you can request for a callback for more details.

SimplyClick SBI Card

The best credit card in India for online or e-shopping. This is good credit card for those who love to shop online. It provides you an enormous amount of rewards and benefits if you are looking for the best credit cards in India for shopping.

Customer Rating: 5 out of 5

Annual Fees: Joining fees is INR 499 and from second year onwards, you will have to pay annual fees of INR 499. Annual fees can be waived off when spending more than INR 1 lakh per year.

Key Benefits:

- You get a welcome e-gift voucher of amazon worth INR 500 along with this card.

- You get 10x Reward points for shopping through online partners with this credit card like Cleartrip, Zoomcar, Bookmyshow, Amazon, etc.

- From this SBI Simply Click Credit Card, you can earn 5x Reward points from all other shopping websites.

- You get e-vouchers of INR 2,000 on every lakh rupee spend through this card annually.

- Surcharge on fuel is been waived off when fuel transaction is between INR 500 – INR 3000.

You can fill the form to get in touch with this credit card representative for further details.

Indian Oil Titanium Citibank Credit Card

This is the best credit card for someone who commutes to the office using his/her car or for someone who refills his car twice a month.

You have a lot of benefits if you get the petrol refilled in your car through IndianOil fuel stations in India.

There is no annual fee on this credit card, however, if you do not spend Rs 30,000 per annum then you will have to pay Rs 1000 as an annual fee.

Benefits

- At IndianOil fuel pumps, you get 4 Turbo Points for every Rs 150 spent on purchasing fuel. (Here 1 Turbo point is equal to Rs 1)

- On every Rs 150 spent on groceries and supermarket, you get 2 turbo points. (Approved list of supermarkets)

- 1 Turbo point on shopping, dining, etc. for every Rs 150 spent.

- Full fuel surcharge on fuel purchased is waived off.

HDFC Platinum Plus Credit Card

This is another credit card just like the Indian oil credit card from HDFC, you can save a lot of money on fuel by redeeming the reward points. Also, there is no annual fee on this credit card and there is an add-on facility which allows you to get an additional 3 credit cards for spouses, children, parents, etc.

Benefits of HDFC Platinum Plus Credit Card

- With every Rs 150 spent, you receive 2 reward points.

- If you report the bank after losing the card within 24 hours, then after that there is no liability on you.

- There is a fuel surcharge waiver of 2.5% on fuel consumption.

- You can avail up to 50 days interest-free from the purchase date.

Read more: What are the common mistakes made by a first time investor in stock markets?

HDFC Bharat Cashback Credit Card

Benefits

- Save up to Rs 3600 by using the Bharat Card.

- Get renewal fee waived on spends of Rs. 50,000 in a year prior to renewal date. W.E.F 15th Feb’19, the spend conditions have been revised from Rs. 20,000 in a year to Rs. 50,000 in a year to avail the benefit of next year renewal fee waiver.

- Do minimum 4 transactions using Credit card every month and get

- Free Accidental Death Insurance upto 50Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

Conditions Apply : Click here

HDFC Bank Diners Club Black Card

Benefits:

- Book Air Tickets / Hotels across 150+ Airlines and Choice of hotels (Domestic & International) at www.hdfcbankdinersclub.com

- Redeem reward points for booking Air Tickets / Hotels across 150+ Airlines and Choice of hotels (Domestic & International) at www.hdfcbankdinersclub.com ( 1 Reward Point = Re. 1 )

- Redeem Reward Point for AirMiles across British Airways Executive Club (Avios), Jet Airways (JPMiles), Singapore Airlines (KrisFlyer Miles), Trident Hotels or Club Vistara. (1 Reward Point = 1 AirMile).Please complete Frequent flyer registration before attempting Airmiles redemption in Netbanking

- Golf Course Referral and Reservation Assistance

- Dining Referral and Reservation Assistance

- Flower and Gift Delivery Assistance

- Car Rental and Limousine Referral and Assistance

- Hotel Referral and Reservation Assistance

- Earn 5 Reward Points for every Rs. 150/- retail spends*

- he capping of reward points is only on the accelerated 10X program and not on any other spends which follows the Regular reward points

- 6 Complimentary Golf games (Green fee waiver) per quarter around 20 golf courses in India and 40 golf courses world over.

- Air AccidentCover of INR 2 Crore

- Emergency Medical Expenses Cover of up to INR 50 Lakh

- Credit Liability Coverof up toINR 9 Lakh

- Travel Insurance Cover of up to INR 55,000 on baggage delay (Capped to 10$ per hour restricted to 8 hours).

Annual fees: Annual Membership fee – Rs. 5000 + Applicable Taxes.Spend Rs. 5L in 12 Months and get Renewal Fee waived for next renewal year.

To apply for this card, click here.

HSBC Visa Platinum Card

Benefits:

- NIL Joining and Annual Fees

- 10% Cashback up to ₹2500 in the first 90 days of issuance

- 3X Rewards on Dining, Hotels and Telecom for first 12 months

- Fuel Surcharge Waiver

- Discounts on Movies, Flights, Restaurants and more

- Air Miles Conversion on Jet Airways and Singapore Airlines.

To apply,click here.

IndusInd Bank Platinum Card

Benefits:

- Welcome gift: The Platinum Credit Card welcomes you with an EazyDiner gift voucher, an e-gift card from MakeMyTrip, gift vouchers from ALDO, William Penn, Armani, Titan, Pantaloons, Hidesign, Woodland, United Colors of Benetton, Satya Paul, Jet Airways and Yatra. The welcome gifts will be sent to the cardholder on payment of joining fees.

- Reward points program: On every Rs.150 spent on the card, you can earn 1.5 reward points on all types of spends except fuel transactions. Reward points can be redeemed for gift vouchers from Indus Moments, Oberoi Hotels & Resorts Stay, Genesis Luxury, Airline Miles on partner airlines, and cash credit.

- Golf privileges: As a privileged card member you can avail complimentary golf games and lessons exclusively conducted at leading golf clubs in Bengaluru, Ahmedabad, Chennai, Hyderabad, Delhi, Pune and Mumbai.

- Travel benefits: Complimentary membership to Priority Pass Program that provides access to more than 600 airport lounges across the globe. You need to pay only the usage fee of the lounge.

- Travel Plus program provides special waivers on lounge usage charges outside India. You can avail the usage fee waiver up to 8 times in a year.

- Complimentary concierge services: Through 24×7 concierge services, the card provides a host of premium benefits such as pre-trip assistance, hotel reservation, flight booking, entertainment and sports booking, gift assistance, and others all with a single phone call. Cardholders can avail concierge services from anywhere in the world.

- Platinum auto assist service: To make sure your journey on the road is uninterrupted, IndusInd Bank provides various on-road services at a simple phone call. You can avail roadside repair service, emergency fuel supply, battery service, flat tire service, accident management, medical assistance, emergency towing assistance and assistance when keys locked inside. The assistance is available 24X7 throughout the year.

- Lifestyle benefits: IndusInd Bank in partnership with Bookmyshow offers free movie tickets for Platinum cardholders. Bookmyshow offers ‘Buy one, get one free’ movie ticket every month. You can avail up to 2 free movie tickets every month.

- Fuel surcharge waiver: You can free yourself from surcharge charged on petrol purchases at fuel stations across India with IndusInd Bank’s surcharge waiver facility. The waiver is applicable on all the fuel transactions worth between Rs.400 and Rs.4,000.

- Zero liability on lost or stolen card: With ‘Total Protect’ program, IndusInd Bank provides complete protection against any unauthorised transactions that happen in case of loss or stolen card. The insurance covers up to 48 days prior to loss reporting.

- Personal air accident insurance: Cardholders will get personal air accident cover worth Rs.25 lakh completely free with the card.

Fees:

Joining fees: Rs.17,999

Annual fees: Nil

Add-on credit card fee: Nil.

To apply,click here.

Axis Bank Neo Credit Card

Benefits:

- Amazon gift voucher worth ₹ 250 on first spend within 30 days of card issuance.

- BookMyShow welcome gift voucher worth ₹ 300.

- Minimum 15% discount on dining at partner restaurants.

- Jabong welcome gift voucher of up to ₹ 500.

- Enjoy ‘Power of 10’ which gets the user 10% off on purchases made on Myntra, BookMyShow, redBus, or mobile recharge done through Freecharge.

Fees:

Annual/Renewal Fee: Rs.250/-

To apply,click here.

Read more: Don’t have enough money to invest? Don’t worry,read on…

Kotak PVR Platinum Credit Card

Benefits:

- Card holder will get 2 free movie tickets of PVR per month if they spend Rs.7500 or above in total within a billing cycle.

- Customer can shop anywhere and for anything to avail the free PVR movie ticket offer round the year. These free tickets cannot be redeemed at PVR IMAX and PVR Director’s Cut additionally, Gold and Europa booking classes are also exempt from this offer.

- Card holder can get 1 free PVR movie ticket every month if they spend Rs. 750 or above in a billing cycle at PVR cinemas as part of the introductory offer. Both online and over the counter ticket purchases are included in this offer.

- In case customer’s PVR Platinum card is stolen or lost, bank provides complimentary insurance cover of Rs. 75,000 under the PVR shield program. Customer has to inform customer service immediately in case of card loss. Claims, if any, have to be filed with HDFC ERGO General Insurance Company.

- Primary card holder can avail of supplementary cards for family members and they feature the same benefit as the primary card. You can pre-set the credit limit on all add-on cards and track expenses made using those cards online.

Fees:

The card attracts annual fees of Rs. 999. There is a charge of Rs. 500 for every instant you go over your card limit and an additional Rs. 500 for every cheque dishonor. Bank charges interest rate at 3.4% per month on the overdue payment amount.

To apply,click here.

Yatra SBI Card

Benefits:

- Get Yatra.com vouchers worth Rs. 8,250 on joining

- Rs. 1,000 off on domestic flight bookings. Min. trxn of Rs. 5,000

- Rs. 4,000 off on international flight bookings. Min. trxn of Rs. 40,000

- 20% off on domestic hotels Min. trxn of Rs. 3,000. Max. discount of Rs. 2,000

- 6 Reward Points on every Rs. 100 spend on Departmental Stores, Grocery, Dining, Movies, Entertainment and International spends

- 1 Reward Point on every Rs. 100 spent on all other categories

- Enjoy exclusive access to the domestic MasterCard airport lounges

- 2 complimentary domestic airport lounge access per calendar quarter

- Complimentary Air Accident cover of Rs. 50 lacs

- Enjoy freedom from paying 1% fuel surcharge across all petrol pumps in India.

Fees:

Annual fee, one time: Up to Rs. 499

Renewal fee, per annum: Up to Rs. 499, from second year onwards

Add-on fee, per annum: Nil.

Click here to apply.

SimplySAVE SBI Card

Benefits:

- Welcome gift of Rs 100 cashback on your first ATM cash withdrawal, if done within 30 days of receiving the card.

- 2,000 bonus Reward Points on spending Rs 2,000 or more on the card within the first 60 days of card issuance.

- 1 Reward Point on every Rs 100 spent on the card.

- 10 Reward Points for every Rs 100 spent on Dining, Movies, Departmental Stores and Grocery Spends.

- Facility to use Reward Points to pay off the credit card bill or to redeem against a wide variety of gifts from different brands (4 Reward Points = Re 1).

- Spend Rs 90,000 or more in one year to avail the annual fee reversal.

- 1% fuel surcharge waiver on transaction worth ₹500 and ₹3,000.

Fees:

Annual Fee: Rs.499/-

Renewal fee: Rs 499, reversed if annual spends for last year exceeds Rs 90,000.

Click here to apply.

ICICI Amazon Pay Credit Card

Benefits:

- Earn 5% back on Amazon.in for Amazon Prime customers*

- Earn 3% back on Amazon.in for non-prime customers*

- Earn 2% back on 100+ Amazon Pay partner merchants by using this card on Amazon Pay *

- Earn 1% back on other payments*

- 15% savings on dining bills at over 2,500 restaurants across India through Culinary Treats Programme.

- Waiver of 1% on fuel surcharge.

Fees:

No joining fee or annual fee.

To apply,click here.

Yes Prosperity Cashback Credit Card

Benefits:

- Welcome Cashback

- Get Cashback of INR 250 on spends of INR 2,500 in first 30 days of card set upa

- Cashback on every transaction

- 5% Cashback on Movie Ticket bookingsb

- 5% Cashback on Grocery Shoppingc

- 0.50% Cashback on all Other retails spendsd

- 5% Cashback on Bill Payments through YES PayNowe

- Please click here to know more

- Attractive Interest Rate on Revolving Credit and Preferential Foreign Currency Markup

- Interest Rate of 2.99% per month (35.88% annually) on Revolving Credit, Cash Advances and Overdue Amount for Cardmembers who have YES BANK Salary or Savings Account relationship

- Interest Rate of 3.22% per month (38.64% annually) on Revolving Credit, Cash Advances and Overdue Amount for Cardmembers who do not have YES BANK Salary or Savings Account relationship

- Preferential Foreign Currency Markup of 3.40% only

- Fuel Surcharge Waiver

- Fuel surcharge waiver at all fuel stations across India for transaction between INR 400 to INR 5,000d

- Lifestyle Benefit : Please visit YES Privileges to know more

- Avail great offers across travel, dining, shopping, wellness and more, in select cities.

Annual Membership Fees

- First Year Membership Fee of Rs 1000 + Applicable Taxes

- Renewal Membership Fee of Rs 1,000 + Applicable Taxes.

To apply,click here.

American Express Membership Rewards Credit Card

Benefits:

- Earn 1,000 Bonus Membership Rewards Points for simply using your Card 4 times on transactions of Rs. 1,000 and above every month

- Earn 5,000 Membership Rewards Points upon First Year Card Renewal, on payment of annual membership fee. Points to be credited within 90 days of Card renewal

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Split the payment and not the joy. Use your American Express Credit Card for your next big purchase & pay in easy EMI.

Fees:

Second Year onwards : Rs. 4,500 plus applicable taxes.

Amex Gold Credit Card

Benefits:

- Effective 1st July, 2017, you earn 1,000 Bonus Membership Rewards Points when you complete 6 transactions each worth Rs. 1,000 or more every month on your American Express Gold Card

- Earn 5,000 Membership Rewards Points upon First Year Card Renewal, on payment of annual membership fee. Points to be credited within 90 days of Card renewal

- Redeem your Points from the fabulous 18 and 24 Karat Gold Collection

- Enjoy benefits on your travel bookings with American Express Travel online.

Fees:

First Year fee : Rs. 1,000 plus applicable taxes

Second Year onwards : Rs. 4,500 plus applicable taxes.

Click here to apply.

ICICI Sapphiro Credit Card

Benefits:

- Get Welcome Vouchers on Shopping and Travel worth Rs 10,000 on payment of joining fee.

- Get up to 20,000 PAYBACK points every anniversary year.

- 4 complimentary domestic airport lounge visits per quarter, courtesy of Mastercard and American Express.

- 2 complimentary international airport lounge visits per calendar year and 2 complimentary domestic airport spa visits per calendar year, under complimentary membership to Dreamfolks DragonPass Lounge Access Programme.

- Enjoy up to 4 complimentary rounds of golf every month at the golf course of your choice based on eligible spends on your card.

- Buy one movie/event ticket and get up to Rs 500 off on the second ticket, twice every month, through www.bookmyshow.com

- Minimum 15% savings on dining bills at over 2,500+ restaurants across India through Culinary Treats Programme.

Fees:

Joining: Rs.6,500 (excluding GST)

Annual: First year->Nil,

Second year onwards->Rs.3,500 (excluding GST).

To apply, click here.

HDFC Solitaire Credit Card

Benefits:

Lifestyle benefits:

When you shop with your HDFC Bank Solitaire Credit Card, you get 3 reward points for every Rs. 150 spent. You can get 50% more Reward Points on dining and grocery spends and can redeem your points for gifts/vouchers from the HDFC reward catalogue.

(Note that only retail purchases qualify for reward points. Cash Advance, fees and other charges do not qualify for Reward Points.)

Solitaire Shopping Benefits:

Your Solitaire Credit Card rewards you for shopping! You can avail of a shopping voucher from Shoppers Stop worth Rs. 1,000 if you spend more than Rs. 75000 in a six-month time frame. You could thus be eligible for 2 vouchers worth a total of Rs 2000 if your overall spend is above Rs 1,50,000 a year over the two six-month time periods.

Solitaire CashBack Benefits:

With the HDFC Solitaire Credit card, you have the power to redeem Reward Points as CashBack against the outstanding amount on your Credit Card (100 Reward Points = Rs. 40). Additionally, you can enjoy a cashback of more than Rs. 4,000 on reward points accrued by spending Rs. 5 lakh annually on your card.

Solitaire Travel Benefits:

You can redeem your reward points against air miles/air vouchers of leading domestic airlines. If you are an avid shopper who travels a lot, the HDFC Bank Solitaire Credit Card is the right choice for you as it combines both shopping and travel benefits.

Other benefits:

- You get a one-time free wellness package from Thyrocare as a welcome benefit

- Earn 3 Reward Points per Rs.150 spent

- Earn 1000 Reward Points upon renewal of card from 2nd year onward

- Get 50% additional Reward Points on grocery & dining spends as part of Accelerated Reward Points Feature.

Fees:

Annual/Joining fees: Nil.

Click here to apply.

HDFC MoneyBack Credit Card

Benefits:

- Do minimum 4 transactions using Credit card every month and get

- Free Accidental Death Insurance upto 50Lakhs*

- Free Fire and Burglary protection for goods above Rs.5000 for 180 days

Conditions Apply : Click here

Spend Milestone Offer : –

Spend Rs 50,000 in a Quarter and get Rs 500 E Voucher.

Fees:

First Year Membership Fee – Rs. 500/- + Applicable Taxes, Renewal Membership Fee – Rs. 500/- + Applicable Taxes.

Click here to apply.

ICICI Coral Credit Card

Benefits:

BookMyShow

- Buy 1 ticket and get the other ticket free any day of the week, on www.bookmyshow.com

- Get up to 2 free tickets per month valued at up to ₹ 250 per ticket

- Successful booking is on first come first serve basis and is subject to daily stock availability

- To book your movie ticket and for detailed Terms & Conditions, please click here

INOX

- Buy 1 ticket and get the other ticket free on booking tickets online at www.inoxmovies.com, Inox app or visit the Inox box office and use your ICICI Bank Coral Credit Card at the ticket counter to avail of the offer

- Get up to 2 free tickets per month, valued up to Rs 250

- Successful booking is on first come, first-serve basis and is subject to daily stock availability

- Book your ticket now on www.inoxmovies.com.

Fees:

- You pay a joining fee of Rs. 500 + GST

- You pay an annual fee of Rs. 500 + GST from 2nd year onwards – waived off if you spend more than Rs. 1,50,000 in the previous year.

Apply now from here.

Standard Chartered Ultimate Credit Card

Benefits:

- This card gives you the privilege to access 20 premier golf courses in India and 150 worldwide.

- Enjoy up to 20% cashback* on uber rides. Offer valid for cardholders with monthly spends of `15,000 (not limited to Uber) till 31 December 2020.

- Enjoy your dine-in even more with 25% discount on top 250 restaurants in India with advance table bookings through concierge.

- Get 5% cashback on duty free spends and low foreign currency markup fee of 2% on overseas spends.

- Get complimentary access to over 100 airport lounges across the world.

- On every spend of Rs 150, Cardholders can earn 5 reward points whereas 1 reward point is equal to Rs 1.

Fees:

Annual fees(first year): Rs 5,000

Annual fees(second year onwards): Rs 5,000.

Click here to apply.

HDFC Regalia Credit Card

Benefits:

- Lowest foreign currency mark up of 2% on all foreign currency spends.

- 50 days of interest free credit. Pay only the minimum amount due and carry forward the balance amount to next month at an extremely low interest charge.

- Air accident cover of ₹ 1 Crore for the primary cardholder. It is applicable in case the cardholder sustains any air accident and suffers bodily injury resulting in death within 12 months of the accident.

- Medical cover of ₹ 15 Lakhs against any medical emergency while travelling outside your home country.

Fees:

Annual fees: ₹ 2,500.

To apply,click here.

Axis Bank Buzz Credit Card

Benefits:

- The Buzz credit card has been specially designed for those individuals who frequently indulge online.

- Along with other exciting benefits, you also get Flipkart vouchers and accelerated Axis Bank credit card reward points.

Online shopping benefits offered by the Axis Bank Buzz Credit Card

- With the Buzz Credit Card, you could avail up to 10% discount on all your purchases on Flipkart.

- You also get 3X Axis eDGE reward points on your online shopping.

- To make high-value purchases easy for you, the Buzz Credit Card also offers the facility of EMI.

Axis Bank Buzz Credit Card Features and Benefits

- Welcome gift: As a welcome gift, you get a Rs.1,000 Flipkart gift voucher on making 3 purchases with the card within the first 45 days of its issuance.

Instant discounts

- You get 10% discount on all spends on Flipkart made from the 1st to the 5th of every month. The maximum benefit is capped at Rs.400.

- You also get 5% discount on all spends on Flipkart made from the 6th to the 31st of every month. The maximum benefit is capped at Rs.200.

Dining offer: You enjoy a minimum of 15% discount on dining bills at partner restaurants in India.

Regular Rewards: You earn 2 Axis eDGE reward points on every Rs.200 spent on the card.

Accelerated rewards: You earn 3 Axis eDGE reward points on your online shopping spends with the card.

Milestone rewards:

- You get Flipkart vouchers of Rs.500, Rs.1,000, and Rs.2,500 if your annual spends on Flipkart are Rs.25,000, Rs.50,000, and Rs.1 lakh, respectively.

- If the overall annual spends on the card exceed Rs.1 lakh and Rs.2 lakh, you get Rs.1,000 and Rs.2,000 worth Flipkart vouchers respectively.

EMI facility: Convert any purchase into EMIs if the transaction amount is Rs.2,500 or more.

Fees:

Joining: Rs.750/-

Annual: Rs.750/-

Click here to apply.

HDFC Snapdeal Credit Card

Benefits:

Rewards Points

For HDFC customers, the credit card offers 3X or even 6X rewards points on some products, associated to the spending of INR 150 on Snapdeal.com.

Offers

With Snapdeal HDFC Credit card you can access special offers provided by Ola, Freecharge and Cleartrip.

Fees:

Annual Fees- INR 500.

Click here to apply.

RBL Platinum Maxima Credit Card

Benefits:

- Earn 2 membership reward points every time you spend Rs 100 for any purchase.

- Get a movie ticket for free when you use your card for purchasing movie tickets on BookMyShow.com (up to Rs 200).

- Enjoy free access to airport lounges in all the major airports, two times every quarter.

- Get 10000 reward points as a bonus when the amount spent on your card for purchases is Rs 2 lakhs or more.

- Get an added bonus of 10000 reward points when the amount spent on your card for purchases is Rs 3.5 lakhs or more.

Fees:

The annual fee for this RBL credit card is Rs 4,000.

The annual fee for supplementary cards if Rs 1,000.

Click here to apply.

SBI BPCL Credit Card

Benefits:

- This credit card has worldwide acceptance and can be used at over 24 million outlets worldwide, including 3,25,000 outlets in India.

- You can avail the add-on card facility and give some more purchasing power to your parents, spouse or children.

- Avail the balance transfer facility to transfer outstanding balances from other credit cards into SBI BPCL Card and pay back in easy EMIs.

- Convert your big-ticket purchases into easy EMIs using the Flexipay feature.

- Get draft or cheque drawn against your credit card using the Easy Money facility.

- Pay your utility bills using the card and never miss a payment.

Fees:

Annual Fee: Rs.499/-

Renewal Fee: Rs.499/-

For application,click here.

ICICI HPCL Coral Amex Credit Card

Benefits:

PAYBACK Points:

You are entitled to earn PAYBACK points on every retail transaction. Earn 6 PAYBACK points for every Rs. 100 you spend on fuel at any HPCL station. Collect 2000 points to get Rs. 500 worth fuel. Earn 2 PAYBACK points on any other retail transaction.

Cashback:

Fill up your fuel tank at any HPCL pump and you will earn 2.5% cashback and 1% savings on fuel surcharges.

Entertainment:

Get Rs 100 discount on 2 movie tickets in a month when you buy tickets on bookmyshow.com. There are a limited number of tickets available per day under this scheme. The discount is available on first come first serve basis.

Culinary Treats program:

You can save 15% at more than 800 participating restaurants. You can visit the culinary treats website or download the app from the Apple Store and Google Play.

Exclusive American Express benefits:

American Express Connect:

Customers can enjoy a number of benefits across categories such as lodging, retail, dining and shopping with a number of merchants.

Epay:

Through Epay, cardholders can make easy online payments for their utility bills in a secure and convenient manner.

American Express ezeClick:

The American Express ezeClick is a quicker, secure and smarter online payment solutions.

Fees:

Annual fee: Rs. 199 + GST. Waived for the first year.

Joining fee: Rs. 199 + GST.

ICICI HPCL Coral VISA/MasterCard/Platinum

Benefits:

- Enjoy 2.5% cashback (maximum Rs 100) when you use your card to purchase fuel at any of the HPCL petrol pumps.

- Get a waiver of 2.5% on fuel surcharge when you use your card for fuel transactions up to Rs 4,000 at any of the HPCL petrol pumps across the country.

- Earn PAYBACK reward points at an accelerated rate (2.5X) when you use your card for fuel transactions at HPCL petrol pumps.

- Earn 2 PAYBACK points every time you spend Rs 100 on your card.

- Get an annual fee waiver of Rs 199 when you spend a minimum amount of Rs 50,000 in a year on your card.

- Get a chance to redeem reward points instantly at HPCL petrol pumps by swiping your PAYBACK card.

Fees:

- For the 1st year, the joining fee is Rs 199 (exclusive of service tax)

- For the 1st year, there is no annual fee.

- From the 2nd year onwards, there is an annual fee of Rs 199, which is waived if Rs 50,000 or more was spent on the card, the previous year.

- There is no fee for a Supplementary Card.

To apply,click here.

American Express Platinum Travel

Benefits:

- Spend Rs. 1.90 Lacs in a year and get Travel Vouchers worth more than Rs. 7,700.

- Spend Rs. 4 Lacs in a year and additionally get Travel Vouchers worth more than Rs. 11,800. Also get a Taj Experiences Gift Cards worth Rs. 10,000 from the Taj Hotels Palaces Resorts Safaris

- Enjoy 4 complimentary visits per year (limited to one complimentary visit per quarter) to 11 airport lounges across India

- Enjoy benefits on your travel bookings with MakeMyTrip.com.

Fees:

First year fee: Rs. 3,500 plus applicable taxes.

Second year onwards: Rs. 5,000 plus applicable taxes.

To apply,click here.

Yes First Preferred Credit Card

Benefits:

- Medical Insurance: Get Rs.25 lakh medical insurance for emergency hospitalization when traveling overseas.

- Credit shield: Also, get credit shield in case of accidental death of the primary cardholder.

- Concierge services: Get 24×7 dedicated concierge assistance who will help you with hotel reservations, flight bookings, restaurant referrals, movie tickets assistance, and flower and gift delivery.

- Automobile assistance: Get 24×7 emergency automobile assistance with your YES First Preferred Credit Card. You can use this service for emergency towing assistance or roadside repair.

- Card Protection Plan: Safeguard your credit card with the Credit Card Protection Plan. This feature protects you in case of loss of card, theft, or fraud.

Fees:

Joining: Rs.2,500

Annual: Rs.2,500.

Click here to apply.

SBI Air India Signature Credit Card

Benefits:

Welcome gift:

- You get 20,000 reward points on paying the joining fee.

- You get a complimentary membership to Air India Frequent Flyer program – Flying Returns.

Milestone reward points:

- You earn up to 1,00,000 bonus points through the achievement of milestone annual spends.

- For annual spends of Rs.5 lakh,you earn 20,000 reward points; for spends above Rs.10 lakh, you get another 30,000 reward points.And when you cross spends of Rs.20 lakh annually, you get another 50,000.

- Therefore, the cumulative bonus reward points that you can earn is 1,00,000.

Regular Reward points:

- You earn 4 reward points for every Rs.100 spent with the card.

- For travel bookings that you make for yourself on the Air India website, you get 30 reward points for every Rs.100 spent. For tickets booked for others, you get 10 reward points.

- The accumulated points can be converted to Air India Air Miles that can be redeemed for travel bookings made on the Air India website. Here, 1 Reward point is to equal to 1 Air India Air Mile.

- Reward points can be converted to Air Miles of Air India within 7 working days.

Complimentary airport lounge access:

- With complimentary membership to airport Priority Pass Programme, you can get entry to over 600 premium airport lounges across the world.

- You will also get free Visa Lounge Access Program membership which gives you 8 complimentary visits per year to domestic VISA lounges across India.

Card renewal benefit:

You get 5,000 reward points every year on paying the renewal fee.

Lost card liability:

You will get a complimentary cover of Rs.1 lakh in case the card is lost or stolen. The cover is applicable from the period of 48 hours prior to reporting of loss till 1 week post the reporting loss.

Fuel surcharge waiver:

1% fuel surcharge waiver valid across all petrol pumps in India on transactions of Rs.500 to Rs.4,000. The maximum waiver per statement cycle is Rs.250.

Balance Transfer on EMI:

SBI Credit Card offers various balance transfer options to transfer the outstanding balance on other bank credit cards to SBI Signature Credit Card at low-interest rates.

EMI facility:

All big-ticket purchases of above Rs.2,500 can be converted into easy monthly instalments at low-interest rates. You need to contact the SBI Helpline within 30 days of the purchase to avail this facility.

Emergency card replacement:

You can get your lost credit card replaced anywhere in the world. SBI’s helplines are open 24X7 to provide assistance for emergency card replacement even when the card member is abroad.

Fees:

Joining: Rs.4999/-

Annual: Rs.4999/- per annum(from 2nd year onwards).

To apply, click here.

SBI Elite Credit Card

Benefits:

- Welcome gift voucher worth ₹ 5,000 that can be used at any one of the partner brands. The partner brands are: Yatra, Hush Puppies/Bata, Marks & Spencer, Pantaloons and Shoppers Stop.

- Concierge Services that provide assistance with gift delivery, customized holiday packages, movie and hotel reservations.

- SBI Card Elite credit card Foreign Currency Mark-up Charge is 1.99%. This is the lowest Foreign Currency Mark-up Charge.

- Users get complimentary Trident Privilege Red Tier membership along with 1,000 Welcome Points on registration.

- Users get complimentary Club Vistara Silver Membership along with 1 complimentary lounge access voucher and 1 upgrade voucher. They also earn 9 club Vistara Points per ₹ 100 spent on Vistara flights.

- SBI Card Elite also offers 2 International Lounge visits quarterly through Priority Pass Program.

- Users also get 2 Domestic Lounge visits quarterly.

- Card Elite users earn 2 Reward Point per ₹ 100 spent on anything other than fuel. 10 Reward Points are earned on Dining, Departmental stores and Grocery Spends.

- Card Elite users also get two complimentary movie tickets worth ₹ 6,000 every year.

Fees:

Annual/Renewal Fee: Rs.4999/-

Click here to apply.

Citi PremierMiles Credit Card

Benefits:

- Spend Rs 1,000 or more in the first 60 days of card activation and get 10,000 miles as welcome gift.

- Get 10 air miles on every Rs 100 spent on airline transactions made at Premier Miles Official Website and hotel bookings made with select partners.

- Access to premium website of ‘Premier Miles’ offering complimentary air travel across the globe.

- Access to domestic and international lounges at airports with light refreshments and business facilities.

- Redeem the air miles against flight tickets, hotel bookings, taxi hire and car rentals.

- Accumulated air miles never expire so they can be redeemed without blackout dates.

- Members of Frequent Flyer Program can earn 10 air miles for every Rs 100 spent on Citi PremierMiles® Credit Card.

- Enjoy up to 15% discount at select restaurants across the country.

- Get complimentary Air Accident Insurance coverage and Lost Card Liability Cover of Rs 1 Crore and Rs 2 Lakh respectively.

Fees:

Annual fee: The Citi PremierMiles® Credit Card attracts an annual fee of Rs 3,000 which will be billed in the first statement and then every 12 months thereafter. The card is complimentary for Citigold Clients.

ICICI JetAirways Sapphiro (Amex)

Benefits:

- A cardholder gets to become a member of the JetPrivilege program and gets 10,000 JPMiles.

- The joining benefit includes a free Jet Airways Economy Class air ticket with a waiver on the base fare.

- The JPMiles and the complimentary air ticket gets credited within 45 days of card activation.

Card renewal benefits

- One can get 5,000 JPMiles on renewing the credit card.

- The renewal benefit includes a Jet Airways Economy Class air ticket excluding the base fare charges.

- A cardholder can get the renewal benefits within 45 business days.

- One can avail a 5% concession on the base fare of air tickets booked through the website of Jet Airways. This offer is applicable on all tickets excluding Light Fare Choices in Economy Class.

Benefits from Jet Airways

- Cardholders get check-in privileges on Jet Airways’ domestic flights.

- The card provides baggage allowance for up to 5 kgs in Economy Class flights and 10 kgs for Premiere Class flights.

- Accelerated JPMiles.

Fees:

Joining: Rs.5000/-

Annual: First year: Nil,Second year onwards: Rs.5000/-

To apply,click here.

Axis Bank Privilege Credit Card

Benefits:

The Axis bank privilege credit card is loaded with innumerable benefits & offers such as travel advantage & several other loyalty privileges for its premium Customer.

Activation Benefit

In case of on joining fee payment, the card holder gets the activation benefit as Yatra voucher of value INR 5,000 on completion of after 3rd transactions within 60 days of issuance.

Milestone Benefit

Once the card holder achieves a usage milestone of INR 2.5 lakhs, the activation benefit would double by converting their EDGE reward points to the Yatra vouchers.

Annual Benefits

The cardholders can earn 3000 edge Reward Points on the renewal of their Axis Bank Privilege Credit Card. This feature is offered only on the payment of annual fee which is levied upfront on their first month Credit Card statement.

Access numerous airport lounges

The cardholder is entitled for 2 Complimentary elect Global MasterCard lounge accesses in a calendar year.

Dining & travel Benefits

Under the program cardholder can relish the beautiful moments of spending quality times with family at some of the top notch restaurants and other exquisite travel destinations. To avail the Extraordinary Weekends’ benefits or enjoy the concierge service, one may logon to www.extraordinaryweekends.com or call at 08880 023 023. Apart from this, Axis bank Privilege cardholders can also avail minimum 15%* off at partner restaurants all over India.

Fuel Purchase benefit

For fuel purchase done using the Axis Privilege card, the cardholder is entitled for refund of the surcharge. This offer would be valid for spending worth Rs. 400 to Rs. 4,000 only and no reward points can be earned for fuel transactions. The maximum benefit under fuel purchase is up to Rs 400 per month.

Axis eDGE Rewards

Under the Axis eDGE Rewards scheme, the cardholder is proffered with 10 reward points on every transition of Rs. 200 and in multiples thereafter for each done domestically or internationally. The rewards points can be redeemed accordingly once more than 500 points are accumulated. The Axis eDGE Rewards Catalogue is available online for selecting the perfect offers

Insurance Protection Benefits

Axis Bank Privilege Credit Card offers insurance cover for the cardholder, his family and other valuable assets as well

- Air Accident Coverage- Max. Rs. 2.5 crore

- Purchase Protection Cover – Maximum Rs. 1 lac

- Coverage for any liability for Lost Card – Maximum Rs. 3 lacs

- Travel Documents being lost during the trip- Covered during any international trip up to 300 USD

- Delay of Checked-In Baggage – Covered during any international trip up to 300 USD

- Loss of Checked-In Baggage – Covered during any international trip up to 500 USD.

Fees:

Standard Joining Fee: NIL for Selected Priority Customers, else Rs 1500

Standard Annual Fee (2nd year onwards): Rs. 1,500.

To apply,click here.

Kotak Royal Signature Credit Card

Benefits:

Unmatched rewards: You are offered 4X reward points for every Rs.150 billed to the card for special categories like dining, travel, air tickets, and international spends. On all other categories, 2X rewards are offered.

Annual fee waiver: If the annual retail spends in a calendar year is Rs.1 lakh, the annual fee will be waived off for both paid and free variants.

Milestone reward points: Spend Rs.4 lakh in an anniversary year and earn 10,000 reward points. For spending Rs.8 lakh, you will earn 30,000 reward points.

A wide array of redemption options: The accrued reward options can be redeemed for redemption options like air tickets, air miles, cash, merchandise options, and mobile recharge with auto redemption facility that makes every purchase more rewarding.

Contactless payment: With Visa payWave technology you can simply tap the card at the card reader to process the transaction. Transactions below Rs.2,000 can be processed without entering the PIN through the payWave card.

Fuel & railway surcharge waiver

- You can avail 1% fuel surcharge waiver on all the fuel transactions valued between Rs.500 and Rs.3,000. The maximum waiver is capped at Rs.3,500 per the calendar year.

- You can also enjoy railway surcharge waiver which is typically charged on railway tickets booking made using credit cards. The maximum waiver amount is capped at Rs.500 per year.

Add-on cards: You can apply for add-on cards that will have the same benefits as the primary card. Also, you can set the spending limit and track spends on each card separately.

Priority services on SMS:

- The priority attend service enables you to get a call back from the bank by sending an SMS. Just SMS to 5676788 and receive a call back within 2 hours.

- The service can be availed to pay monthly dues, to request a cheque pick-up and others.

Cover against fraudulent transactions: Cardholders get Rs.2.5 lakh cover against fraudulent use of the credit card in case of loss or theft of the cards. Fraudulent transactions of up to 7 days before reporting the loss of card will be covered.

Fees:

Joining fee (paid variant): Rs.1499

Annual fee: Rs.999.

To apply,click here.

SBI IRCTC Credit Card

Benefits:

- Get up to 10% of the value of your purchase in reward points when you book AC1, AC2 and AC CC on www.irctc.co.in.

- Get 1 reward point for every Rs. 125 spent on your card on retail purchases including railway tickets, but not including fuel.

- You can redeem these points on www.irctc.co.in for railway tickets.

- You also get 1.8% transaction fee discount when you book on www.irctc.co.in.

- 2.5% fuel surcharge waiver across all petrol pumps in India for transactions between Rs. 500 and Rs. 3000. Save up to a maximum of Rs. 100 per credit card cycle.

- You are automatically insured for Rs. 10 lakh rail accident cover while travelling with a valid train ticket bought with your IRCTC SBI Card.

- IRCTC constantly has offers for railway and flight tickets, hotel accommodations and tour packages.

Fees:

Joining: Rs.500/-

Annual(from 2nd year onwards): Rs.300/-

Click here to apply.

Axis My Zone Credit Card

Benefits:

My Zone credit card has some unique features that make it stand out from other credit cards. Here are a few features of the Axis Bank My Zone credit card:

Add-On Cards: One of the best features of the Axis Bank My Zone credit card is that the cardholder can authorise his loved ones to make purchases on his account with the help of one or more add-on cards. Family members above the age of 18 years including parents, spouse, children, and siblings are eligible to get an add-on Axis Bank My Zone credit card. In fact, you will earn 100 eDGE loyalty reward points on the issuance of your first add-on My Zone credit card.

Cashback: The Axis Bank My Zone credit card comes with a 25% cashback offer on movie ticket purchases at the box office or online bookings. The credit cardholder can get annual cashback up to Rs. 1,000 every calendar year (January 1 to December 31). The credit card is billed for the complete transaction amount during the transaction and the cashback appears as an entry in the account statement.

eDGE Loyalty Rewards: Axis Bank has a lucrative eDGE Loyalty Rewards programme that lets you receive gifts in exchange for spending your eDGE loyalty points. Axis Bank My Zone credit card lets you earn from a range of 4 to 40 points for every Rs. 200 spent on the card. You also get 100 points on your first online transaction with the credit card. There are exciting rewards for weekend shopping and dining of 5x points and 10x points respectively. You can redeem these points at https://edgerewards.axisbank.com/ by choosing products from the eDGE Loyalty Rewards Catalogue.

Complimentary Lounge Access: Frequent as well as occasional travellers can get complimentary access to select airport lounges within India with this credit card. Usage of the participating airport lounges under this programme is subject to a limit / quota every quarter pre-determined by Visa.

Fees:

Joining: Rs. 500 waived off on spending Rs. 5,000 in a period of 45 days

Annual:

- 1st year: Nil

- 2nd year onwards: Rs. 500.

Click here to apply.

ICICI Bank Expressions Credit Card

Benefits:

With the ICICI Bank Expressions Credit Card, personalise your card to make it as unique as you are. Be it your passions or your dreams, you can have it all on your Expressions Credit Card. Choose from our extensive gallery of custom designs to personalise your card.

The ICICI Bank Expressions Credit Card brings you a host of privileges for your benefit. Take a look at Key privileges of this card.

- Earn 3 PAYBACK Points per ₹ 100 spent for all retail purchases except fuel

- Enjoy ₹ 100 discount on up to 2 movie tickets per month at www.bookmyshow.com on first-come-first-serve basis

- 1 complimentary domestic airport lounge visit per quarter

- Minimum 15% savings on dining at over 2,100 restaurants courtesy our Culinary Treats programme.

Fees:

- You pay a Joining Fee of ₹ 499 + goods and services tax.

- You pay an Annual Fee of ₹ 499 + goods and services tax from 2nd year onwards – waived off if you spend more than ₹ 1,50,000 in the previous year.

Click here to apply for this card.

Kotak PVR Gold Credit Card

Benefits:

- You earn 1 complimentary PVR movie ticket if the total value of your card transactions is Rs.10,000 or above in a month.

- If you spend more than Rs.15,000 in a month, you get 2 complimentary PVR movie tickets.

- 1st swipe benefit: As a gift for the 1st swipe of your card, you get a voucher code from PVR within 60 days of the swipe.Card safety: If the card is misplaced or stolen, you can receive an insurance cover, through PVR Shield, of up to Rs.50,000 in a year.Add-on cards with same features: You can choose to opt for an add-on card and set the spending limit accordingly. The add-on card also falls within the insurance blanket of PVR Shield.

Fees:

Joining: Nil

Annual: Rs.499/-

To apply for this card,click here.

HDFC Titanium Times Credit Card

Benefits:

Movie and dining offers: The Times Credit Card provides you with round-the-year discounts and other offers at participating dining and movies in your city.

Visit www.hdfcbank.timescard.com to check exclusive dining and movie offers available at participating partners in your city. You can get a flat discount of 25% on movies and up to a whopping 15% on dining.

Reward points program

- Earn 2 points on every Rs.150 spent on all retail purchases.

- Dine on weekdays (Monday to Friday) and earn 5 points on every Rs.150 spent.

- Reward points can be redeemed for exclusive gifts from the HDFC rewards catalogue.

- The accrued points are valid for 2 years from the date of accumulation.

Fuel surcharge waiver: Fill fuel anywhere in the country and pay using the Titanium Times Credit Card to enjoy zero surcharge on the bill. The waiver is capped at Rs.250 every billing cycle.

Contactless payment: Enabled with contactless payment facility, the Times credit card provides fast, easy and secure payments at retail outlets.

Enjoy the contactless feature for all your everyday purchases below Rs.2,000. Find the contactless symbol on your card and use it at merchant locations that accept contactless cards.

Zero liability on lost card: If the card is lost or stolen, report it within 24 hours and carry a zero liability on fraudulent transactions (if any), thereafter.

Fees:

Joining/annual: Rs.500/-

To apply,click here.

Kotak Essentia card

Benefits:

Extra savings: You earn 1 Saving Point for every Rs.250 spent on other categories (non-departmental & non-grocery).

Attractive redemption choices:

- The accumulated saving points can be easily redeemed online for cash, airline tickets, air miles, movie tickets, mobile recharge, and branded merchandise.

- For redeeming the points for airline tickets, merchandise, and mobile recharge, the reward points must be converted into Easy Points and 1 Saving Point = 2 Easy Points.

More offers and benefits: You are also eligible to avail a host of promotional offers such as dining deals, vacation offers, etc.

Priority service: Get access to priority customer service with KASSIST. Just send an SMS KASSIST to 5676788 from the registered mobile number and get a call from the bank within 30 mins for assistance.

Add-on cards: Add-on credit cards have the same benefits and features as the primary card. You can set individual limits on each card and track spends on them.

Contactless facility: The Visa payWave feature in the card allows you to pay for transactions of up to Rs.2000 using the contactless facility without entering your card PIN. It makes it a safer, secured, and faster mode of payment.

Milestone rewards:

- On spending Rs.1.25 lakh in 6 months with the card, you earn 1200 Reward Points or 6 complimentary PVR tickets.

- For redeeming these points, you can opt for a maximum of 12 complimentary PVR tickets every year.

- You can also opt to adjust the points with your next billing cycle statement or even choose one from air tickets, air miles, mobile recharge, movie tickets, and branded merchandise.

Fees:

Joining: Rs.1499/-

Annual: Rs.749/-.

Click here to apply.

American Express® MakeMyTrip Credit Card

Benefits:

- Welcome Gift: 2 MakeMyTrip vouchers, each worth Rs.1,000

- Spend Rs.1.25 lakhs in a year to get: MakeMyTrip voucher worth Rs. 2,000

- Spend Rs.2.5 lakhs in a year to get: MakeMyTrip voucher worth Rs. 5,000

- 5 Payback Points for every Rs. 100 spent on MakeMyTrip & 2 Payback points on every Rs.100 spent elsewhere.

- Additional 5% cashback on MakeMyTrip bookings.

RBL Moneytap credit card

Benefits:

- This card is equipped with the unique MoneyTap Credit Line facility that enables the cardholder to use credit as they like. They can use the MoneyTap app to transfer funds to their bank account and use the RBL MoneyTap credit card to make purchases.

- Cardholders can avail a credit limit of a minimum of Rs.3,000 and a maximum of Rs.5 lakh.

- Cardholders have to pay an interest only if they transfer money or use EMI conversion. The leftover amount is available to the cardholder at no extra cost.

- Cardholders can avail a tenure of their choice that can vary from 2 to 36 months.

- This card doesn’t require any collateral or guarantors.

- Cardholders can use this card to shop online or swipe it at a merchant store and can just tap to transfer money instantly to their bank account.

- Cardholders can keep a track of the EMIs and credit limit using the app.

- Whenever the cardholder pays back an EMI, the credit limit on their card is topped up by the same amount.

Fees:

Annual: Rs.499 plus GST.

Click here to apply.

SBI Gold credit card

Benefits:

- Add-On Cards

- Utility Bill Payment Facility

- Balance Transfer on Equated Monthly Instalment (EMI)

- Flexipay

- Easy Money

- Online Booking of Railway Tickets

- SBI Card Drop Box Locater.

Fees:

Joining/Annual: Rs.299/-

SBI FBB StyleUP Card

Benefits:

Welcome gift: The co-branded credit card welcomes you to the world of shopping benefits with an Fbb gift voucher worth Rs.500. The voucher can be redeemed within 1 year from the date of issue at any Big Bazaar or fbb stores.

Discount offer: Get round-the-year discount of flat 10% whenever you purchase apparel, accessories, footwear, and bags from any Fbb and Big Bazaar stores. There is no minimum purchase amount nor cap on the discount. You can shop any number of times you want and get a 10% discount every time you shop.

Reward points: Earn accelerated reward points every time you shop. Using the Fbb SBI STYLEUP Credit Card at Big Bazaar, Food Bazaar outlets, and Standalone Fbb stores will bring you 10 times more reward points. The accelerated benefits can also be earned on dining spends.

Savings on fuel bill: Use your credit card to pay your petrol bills and avail 1% fuel surcharge waiver. The offer is valid across all petrol stations in India on all transactions of Rs.500 to Rs.3,000. Maximum waiver is capped at Rs.100 per billing cycle.

Quick and secure transactions: Powered with contactless technology, the STYLEUP credit card enables faster and secure transactions especially at point of sale terminals. If you don’t find a terminal that accepts contactless payments, you can still use your card which also has an EMV chip to allow chip-enabled transactions.

Fees:

Joining: Rs.499/-

Annual: Rs.499/-(from 2nd year onwards).

Click here to apply.

Standard Chartered Super Value Card

Benefits:

- Card holder gets 5% cash back when the card is used for refueling your vehicle. The offer is valid across all petrol pumps and not restricted to any particular vendor. Customer gets 2.5% surcharge waiver and 2.5% as cash back on the transaction.

- One can reduce his phone bills as this card helps you to get cash back of 5% on all telecom payments across all service providers like Airtel, Reliance, Vodafone, BSNL, MTNL or Tata Indicom.

- Further savings on utility bills as this card provides you attractive cash back of 5% on all utility payments such as electricity, water and gas.

- Card holder gets 1 reward points on spending of Rs. 150 across other expense categories.

- Customer enjoys zero liability if card is lost or stolen and is reported immediately to the customer care center.

- Minimum transaction amount for cash back eligibility is Rs. 750, maximum cash back allowed on each transaction is Rs. 100 and the per month cash back limit is capped at Rs. 500.

Fees:

Annual: Rs.750/-

Click here to apply.

HDFC Bank Freedom Credit Card

Benefits:

- Get 500 reward points as welcome gift.

- Reach annual spends of Rs. 90,000 or higher and get gift voucher worth Rs. 1,000.

- Spend Rs. 60,000 in a year and get the renewal fee waived off in the subsequent year.

- Earn 1 reward point for every Rs. 150 spent.

- Earn 5 times more reward points on Dining, Movies, Groceries, taxis and railway ticket booking with maximum points capped at 1,500 per statement.

- Accelerate your reward earnings 10 times on PayZapp & SmartBuy spends with maximum points capped at 1,500 per statement.

- Earn 25 times more rewards on your birthday spends.

- Enjoy 1% fuel surcharge waiver on minimum transaction of Rs. 400 with maximum cashback capping of Rs. 400 per statement cycle.

- Redeem your rewards for vouchers or direct statement credit.

Fees:

Joining/renewal: Rs.500/-

To apply,click here.

IndusInd Duo Card

Benefits:

- You earn 1 reward point for every Rs.150 that you spend through your IndusInd Bank Duo Credit Card.

- You can redeem your accumulated reward points against a variety of options from Indus Moments. You could opt for purchase of personal care and beauty products, home and kitchen appliances, electronic goods, or vouchers from Genesis Luxury and Oberoi Hotels and Resorts.

- You could also opt for redemption against cash credit which gives you Rs.0.75 for every reward point that you accumulate.

- You could also consolidate your points by transferring the ones earned on the Duo Debit to Duo Credit and enjoy an evergreen rewards program. However, this feature is not available for Duo Credit Card with zero limit.

- ‘Buy 1 Get 1 free’ offer once per month for tickets booked on BookMyShow. The maximum price for the free ticket is Rs.250.

- For availing it, you have to apply under the ‘Avail Offers & Discounts’ tab and then from the drop-down menu, select ‘IndusInd Bank Credit Card Offer’

- Enjoy complimentary Priority Pass Membership that gives you access to 700 lounges across different countries

- On fuel transactions between Rs.400 and Rs.4,000 at any petrol pump in India, you will enjoy a waiver of 1%. However, the service tax levied won’t be waived.

- Enjoy insurance coverage of up to Rs.1 lakh against lost baggage, Rs.25,000 against delayed baggage, Rs.25,000 against the missed connection, Rs.25,000 against loss of ticket, and Rs.50,000 against loss of passport.

To apply,click here.

Kotak Bank League Platinum Credit Card

Benefits:

- Kotak League Platinum credit card is accepted globally and cardholders can make credit purchase at any merchant outlet store worldwide.

- Kotak will assist you in making booking and reservations when it comes to travel. Stay and more.

- Assistance in less than 2 hours, cardholders just have to send a SMS.

- EMI Payments at no extra cost when you make costly purchases

- You can withdraw up t0 50% of your credit limit at no interest in any ATM.

- Pay substantially less when you use the card for road and rail travel.

- Fuel surcharge waivers for transactions between Rs.500 and Rs.3000.

- Railway surcharge waiver of 1.8% for online transaction on IRCTC portal and maximum 2.5% surcharge waiver for tickets booked on counters.

Fees:

Annual: Rs.499. Annual fee will be waived off on minimum retail spends of Rs.50,000 on first year and also from second year onwards.

Click here to apply.

RBL Bank Platinum Plus Supercard

Benefits:

- Get 10,000 reward points on crossing a yearly spends of Rs.1,50,000

- Get complimentary airport lounge access, up to 2 times in a year, along with unlimited paid access

- Get 1 Reward Point on every Rs.100 spent on regular expenses

- Get 2 reward points for every Rs.100 spent on online usage

- Get annual savings of up to Rs. 11,000+. Save even more with unique features like personal loan, cash access, and easy EMIs at no additional cost

- Get 1+1 free movie ticket (up to Rs. 200) on www.bookmyshow.com once a month (Valid from Monday to Friday)

- Fill your vehicle with fuel across any pump and get fuel surcharge waiver up to Rs. 100 per month

- Interest-free cash withdrawal up to 50 days

- Interest-free loan on cash limit for up to 90 days, once a year

- Shop for durables, electronics, and much more and divide all you buy into easy EMIs.

Fees:

Annual: Rs. 999 + GST.Fee Waiver on Annual Spends of up to Rs.50,000.

Click here to apply.

American Express Payback Credit Card

Benefits:

- Earn multiple Points from more than 50 PAYBACK partners and 2 PAYBACK Points from American Express PAYBACK Credit Card for every Rs. 100 spent

- Get Flipkart voucher worth INR 750 on taking 3 transactions within 60 days of Cardmembership

- Flipkart vouchers worth Rs. 7,000 on spending Rs. 2.5 lacs in a Cardmembership year

- You will earn a Flipkart voucher worth Rs. 2,000 on spending Rs. 1.25 lacs in a Cardmembership year. Additionally, you will earn a Flipkart voucher worth Rs. 5,000 on spending Rs. 2.5 lacs in a Cardmembership year.

Fees:

First year fee: Rs. 750 plus applicable taxes.

Second year onwards: Rs. 1,500 plus applicable taxes.

To apply,click here.

HSBC Smart Value Credit Card

Benefits:

Introductory offers

- BookMyShow vouchers worth Rs.200 within 60 days of the card issuance.

- You will also receive complimentary Gaana+ subscription for 3 months within 60 days of card issuance. Redemption must be done within 30 days of receiving the coupon code.

Welcome benefits

- Use the card to make a purchase within 30 days of card issuance and get a Cleartrip voucher worth Rs.2,000. The vouchers will be sent to you within 60 days after completing 30 days from card issuance.

- Make a minimum of 5 purchase transactions of total worth Rs.5,000 or more within first 60 days of card issuance and get 10% cashback on the spent amount. The cashback amount is, however, capped at Rs.1,000 per customer.

- For products booked within 90 days of the card issuance, you can avail attractive EMI instalment plans at 10.99% per annum.

Reward program:

- You earn 1 reward point on every Rs.100 spent on the card.

- You earn 3X reward points on online shopping, telecom relate and dining with a maximum of 1,000 points per month.

- The accrued points can be redeemed for a variety of gifts and vouchers from HSBC rewards catalogue.

Movie benefits: Spend Rs.15,000 in a calendar month and win a voucher worth Rs.200 from BookMyShow. The maximum voucher amount is capped at Rs.1,200 per calendar year.

Annual fee waiver: If the total spends in a year exceed or is equal to Rs.50, 000, the annual fee for the next year will be waived off. In case, you aren’t eligible for the fee waiver.

Access to various EMI products:The HSBC credit card offers you various EMI products like Cash-on-EMI, Loan-on-Phone, Instant EMI, Balance Conversion, and balance transfer.

Other features:In addition to the above-mentioned facilities, HSBC Smart Value Card also offers regular credit card benefits such as cash withdrawal facility, global acceptance, extended credit facility, 24×7 customer assistance and lot more.

Fees:

Joining: Nil

Annual: Rs.499 (Waived off on spending Rs.50,000 in a year).

Apply from here.

ICICI Bank RubyX Credit Card

Benefits:

- You can choose spending category such as shopping, travel, utilities, etc. Earn up to 6 Payback points on every spending of Rs. 100 under the selected category.

- Card holder will get surcharge waiver of 2.5% when the card is used to refuel at any fuel outlet in India. The maximum single transaction amount eligible for this benefit is Rs. 4,000.

- Customer can use premium concierge services of i-Assist for making travel bookings, hotel reservations, movie and restaurant bookings as well as much more.

- Card holder is eligible to get discounts of 15% and above at partner restaurants featured in the culinary treats program.

- You also receive the benefit of complimentary air accident insurance of Rs. 1 Crore as well as lost card liability of Rs. 50,000 that covers expenses of up to 2 days before the card loss was reported.

Fees:

- You pay a Joining Fee of ₹ 3,000 + goods and services tax and get welcome vouchers of shopping and travel worth Rs 5000 within 30 days of payment of joining fees.

- You Pay an Annual Fee of ₹ 2,000 + goods and services tax from 2nd year onwards. This fee is waived off if you spend more than ₹ 3,00,000 in the previous year.

Click here to apply.

HSBC Premier Card

Benefits:

Relationship Manager:

HSBC provides a Relationship Manager for each card holder for financial planning and also to offer advice on investments. Supported by a team of wealth management specialists, the “Goal Planner” tool offers custom made wealth solutions to all Premier banking customers. Managing a customer’s personal economy is an easy task with different digital solutions additionally provided by HSBC.

Preferential Access:

HSBC Premier MasterCard Credit Card holders can enjoy preferential access along with tailor made benefits and lifestyle privileges.

Welcome Offers:

Premier Banking customers can receive welcome offers from HSBC in the form of Amazon gift vouchers worth Rs 7500, for a purchase value of Rs 1000 within the first two months of card issue.

Anytime, Anywhere Solutions:

Premier customers can access their credit card accounts from any corner of the globe, using the internet banking facility. HSBC also provides 24/7 customer service to card holders for any queries related to their card accounts. Card holders can also place requests for emergency card replacements and emergency cash at any branch of HSBC, across the world. The emergency card replacement will be done within 24 hours.

Fees:

Annual/joining: Card is offered based on the HSBC Premier relationship.

HDFC All Miles

Benefits:

- You can avail some select features and benefits such as a welcome gift of 1000 redeemable cash points as well as another 1000 reward points when you renew your credit card.

- You can earn double the reward points if you do all your travel related reservations and shopping on AllMiles official website.

- Rotating Credit is another feature that comes with minimal interest rate.

- You can borrow money at no interest for 50 days from the date you get the cash or make a purchase. Interest will be levied only after this period.

Apply here.

HDFC Infinia Credit Card

Benefits:

- Don’t stop when you shop

The HDFC Bank Infinia Credit Card offers a minimum credit limit of Rs 10 lakhs and is equipped with an exclusive “No Pre-set Spending Limit” (NPSL) feature. This flexible limit allows cardholders to spend above the assigned credit limit. The bank also ensures that your card is safely protected from fraudulent transactions at every moment.

- Travel in style

Infinia Credit Card’s Priority Pass Membership gives you special access to 1000+ airport lounges across the globe. Cardholders enjoy complimentary Club Vistara Gold Membership which offers unmatched benefits on Vistara. Also, to compliment your global travel, the bank charges the lowermost markup fee (2%) on every foreign currency transaction through the credit card.

- Lifestyle

Cardholders can enjoy the benefits of Personal Concierge service which helps them personalize their travel, entertainment as well as business experiences. So whether it is arranging for limousine transfers, making reservations at award winning restaurants, planning the special days or sourcing luxury items from across the globe, Infinia Credit Card customers can enjoy it all. Also, cardholders get access to the some of the world class golf courses across the globe and enjoy complimentary games. (Toll Free Numbers: 1800 118 887 / Landline No.: 022 42320226. Email ID: membersupport@hdfcbankinfinia.com)

- Dining

HDFC bank has partnered with some of the finest restaurant chains covering more than 3000 eateries in the country to provide exclusive discounts and offers. Infinia cardholders can get a minimum of 15% discount on those restaurants.

- Rewards Programme

Infinia cardholders earn 5 points for every Rs. 150 that they spend through the card. They can also double their rewards if the purchases are made for dining (only stand-alone restaurants) or on bookings done on www.hdfcbankinfinia.com or www.airvistara.com. The points earned can be redeemed for exclusive gifts from the rewards catalogue.

- Financial Benefits

Cardholders get exclusive benefits on the Infinia credit card at lowest costs. They get the lowest markup (2% + GST) on foreign transactions, up to 50 days of no interest credit period, mere 1.99% interest rate on carry forward outstanding balances or 1% convenience fee waiver on fuel transactions.

- Priority Customer Service

Infinia cardholders can call the customer service team to get the query resolved regarding the credit card in the least possible timeframe.

- Unparalleled Protection

Infinia Cardholders also get travel insurance amongst the numerous benefits. It includes the below mentioned complimentary features:

- Accidental death: In case of an air accident, a compensation of Rs 3 crores will be paid to the nominated next of kin.

- Medical coverage: The primary card holder is covered up to Rs 50 lakh against medical emergencies during overseas travel.

- Credit shield: The outstanding balance is covered to an extent of Rs 9 lakh in case of accidental death or permanent disability.

- Card Liability Cover: Cover up to Rs 9 Lakh available for Primary Card Holder.

Fees:

An applicant can avail exclusive benefits offered by the Infinia Credit Card at only Rs 10,000 (Exclusive of GST) in the first year and annual renewal membership fee of the same amount in subsequent years. However, the renewal fees can be waived off in case of spends of Rs 8,00,000 with the year.

Click here to apply.

Axis Bank Reserve Credit Card

Benefits:

- Cardholders can avail attractive benefits each time they renew their annual membership.

- Cardholders can avail a complimentary chauffeur-driven luxury car ride to the Taj for a delectable meal at their restaurants. They can share these special moments with their loved ones.

- Cardholders can get complimentary Lifestyle luxury vouchers that would let them enjoy retail therapy at high-end stores like Giorgio Armani, Bottega Veneta, Jimmy Choo, and others.

- Cardholders can earn unlimited complimentary Priority Pass lounge access to more than 900 airport lounges across the world.

- Cardholders can avail Club Vistara Platinum membership following which they can enjoy the benefits that comes with it.

- Cardholders can enjoy the convenience of not having to stand in queues any more. One getting the Axis Bank Reserve Credit Card, they will have yQ agents meet them on arrival at an airport to ensure a smooth track immigration.

- Cardholders can get access to lots of beautiful golf destinations along with complimentary rounds of golf across the globe throughout the year.

- Cardholders can avail the Hilton Hhonors Membership with a complimentary Gold Status on it.

- Cardholders can avail VIP Privileges and upgrades with partner luxury boutique resorts and hotels at the Luxury Hotel Collection.