NEFT and RTGS are two different fund transfer mechanisms. The Reserve Bank of India manages it. Almost every bank uses this method of fund transfer. The introduction of these two methods has eased the fund transfer.

Effective from 10th July 2017, RBI will be going to introduce the new NEFT timings and RTGS timings. Let us see the changes. It will hugely impact us in many ways.

Contents

What is the meaning of NEFT or National Electronic Funds Transfer?

It is a nationwide payment system facilitating one-to-one fund transfers. Using this system, you can transfer funds from any bank branch to any individual having an account with any other bank within India.

Let us take an example. Mr.X has a bank account with HDFC and he wants to transfer the money to Mr.Y, whose account is with ICICI. Therefore, by using NEFT facility Mr.X can transfer money to Mr. Y’s bank account.

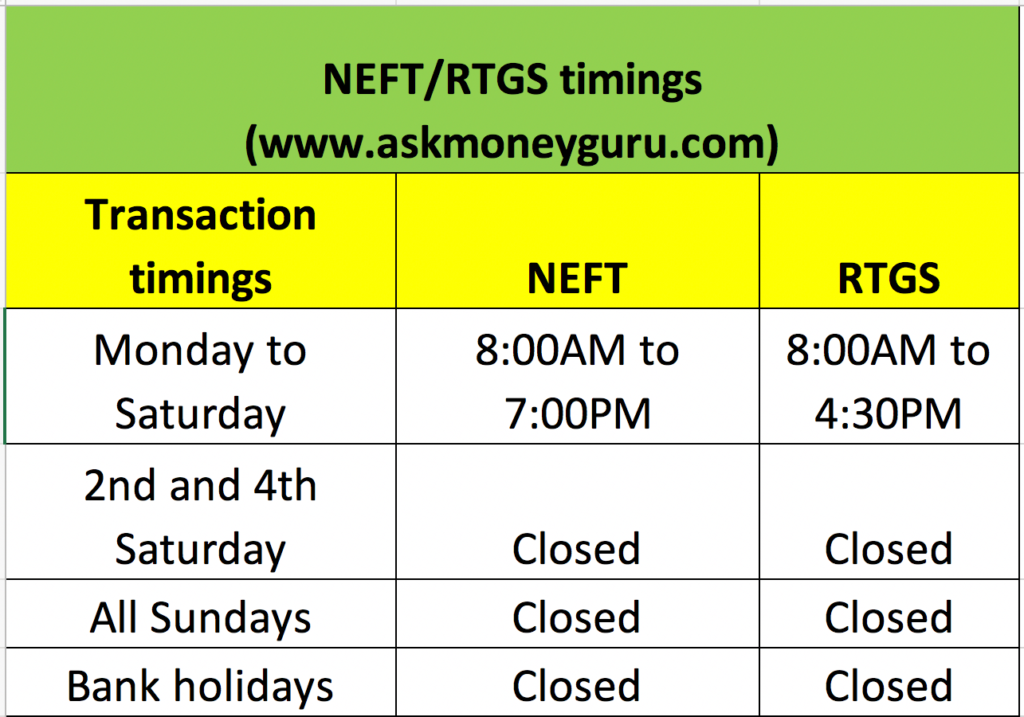

Existing NEFT Timings

Currently, NEFT operates in hourly batches – there are twelve settlements from 8 AM to 7 PM during weekdays (Monday through Friday) and 6 settlements from 8 am to 1 pm on Saturdays.

The money will be transferred in a batch. Any money transfer you initiated during 8 AM to 9 AM, will be settled at 9 AM. Likewise, it will be settled in batch wise.

NEFT Timings of RBI

The Reserve Bank of India settles NEFT transaction in batches. It gathers all transfer mandates and settles them after every half an hour.

Read more: 30 ways to save money

Daily NEFT Timings of Operations

The settlement of the first batch takes place at 8 AM.

The last batch of settlement takes place at 7 PM.

There are total 23 settlements of NEFT in a day.

Holiday of RBI NEFT Settlement

The RBI settles the NEFT transaction in all working days. It does not take place on the following days

- There is No Settlement on Sundays

- No Settlement on 2nd and 4th Saturdays of a Month.

- No Settlement on Declared Bank Holidays.

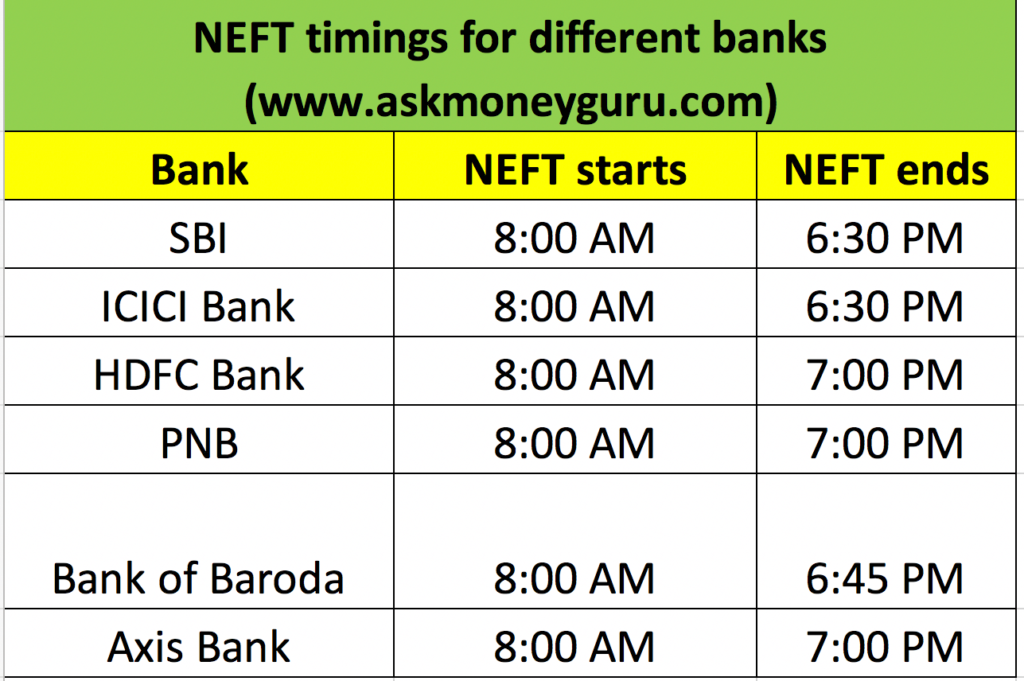

NEFT Timings of SBI, ICICI, HDFC, and Other Banks

The RBI has its own time of NEFT settlement. But banks can tweak there timing within the time range of RBI settlement. Hence, there can be a slight difference in the NEFT timings of different banks.

What is the meaning of RTGS-Real Time Gross Settlement?

In NEFT, money transfer requests are clubbed together called batches. Such batches are settled based on Deferred Net Settlement (DNS) on hourly base during NEFT timings. Whereas in RTGS it is real-time. It means money is transferred individually instead of batches. Therefore, money transfer in the RTGS system is faster than NEFT.

Let us take an example. Mr.X has a bank account with HDFC and he wants to transfer the money to Mr.Y, whose account is with ICICI. Therefore, by using RTGS facility Mr.X can transfer money to Mr. Y’s bank account instantly. In this transaction, HDFC transfers the initiated transfer amount to ICICI bank instantly. However, ICICI bank has a maximum of 30 minutes time to deposit into Mr. Y’s account. Hence, depending on the beneficiary bank’s procedure within two hours Mr.Y get the amount in his account.

Read more: How can you cut down on your income tax?

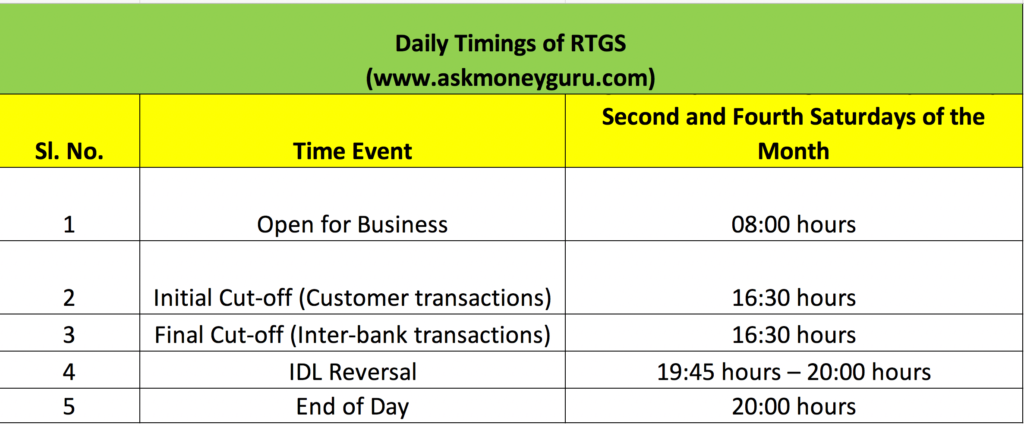

RTGS Settlement Timings of RBI

The RTGS settlement takes place continuously. In this system, you do not wait for the next batch of settlement. Every RTGS mandate is settled immediately. But, the RTGS does not transfer less than ₹2 lakhs. There is no maximum limit. The RTGS also has cut off timings.

The holiday of RBI RTGS Settlement

The RTGS settlement takes place on all working days. It does not work on the following days.

- Sunday is off

- No Settlement on 2nd and 4th Saturdays of a Month.

- The RTGS settlement does not happen on declared holidays.

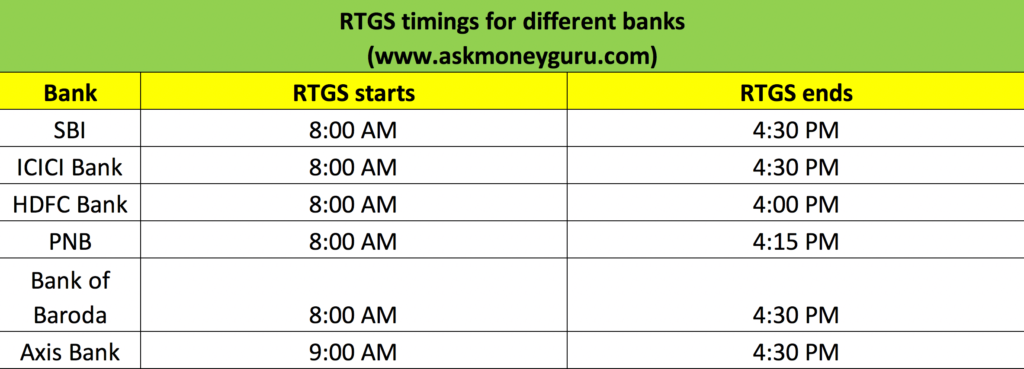

RTGS Timings of SBI, ICICI, HDFC, and Other Banks

The RBI has its own time of NEFT settlement. All the banks follow the schedule given by the RBI. Thus for customers, the RTGS timings end at 4:30 PM. Few banks stop taking RTGS transaction at 4 PM.

RBI Holidays For RTGS

- Republic Day – 26 January

- Annual Closing of Banks- 1st April

- Good Friday –

- B R Ambedkar Birthday – 14 April

- ID- ul- Fitr

- Independence Day – 15 August

- Bakri Eid

- Vijaya Dashami

- Mahatma Gandhi Jayanti – 2 October

- Christmas – 25 December

Do you find NEFT or RTGS timings unsuitable for you? Why don’t you try the IMPS or UPI? These two fund transfer systems are available all days 24 hours.

You may also like:

Retirement Planning|Huge benefits of starting early in your 20s