Contents

“The future belongs to those who believe in the beauty of their dreams” — Eleanor Roosevelt

We all dream of becoming rich and having all the good things that life has to offer. We want a splendid villa, a shining sports car, foreign trips to abroad etc. The list is endless. Some of us want to plan for our child’s higher education or marriage while some other may want to plan to buy a car or a house.

Whatever is our dream we need to know how to plan for it and how to invest in different products so that we can accumulate the required money to fulfill that dream.

Set goals & write them down

This is the first and most important step. Unless we write down our goals we will never be able to clearly define it in our mind. Goals should be SMART, i.e.

S=Specific

M=Measurable

A=Achievable

R=Results focused

T=Time bound.

Be as specific about the financial goal as you can be. Avoid all sorts of ambiguity and vagueness. For example, just saying “I want to be rich” is not enough. You need to define how much money you want to have so that you can call yourself as rich. Something like “I want to have 1 crore rupees” is more specific.

Goals should be measurable so that you have tangible evidence that you have accomplished the goal. Goals should be achievable; they should stretch you slightly so you feel challenged but defined well enough so that you can achieve them. You must possess the appropriate knowledge, skills, and abilities needed to achieve the goal.

Goals should measure outcomes, not activities. It is mandatory to link a goal with a deadline so that we know by when we should meet our targets. Without such a deadline, the goal is unlikely to produce a relevant outcome.

Determine whether it’s a short-term or a long-term goal

Depending on the deadline that you have set for yourself, the goal can fall into either of the below categories:

- Short term:

If the goal needs to be accomplished within the next 5 years.

- Long term:

If the deadline set is beyond 5 years.

Write the current amount of money required to achieve that goal

Let’s suppose I want to buy a car after 2 years which costs Rs. 5 lakhs today including everything. Then after 2 years, the price will not remain the same. At the current rate of inflation, the price will become higher than this. And it will keep on increasing as the duration increases. So the important thing here is to know what is the amount required to fulfill our goal after 2 years.

Calculate future value of that amount considering inflation

Once we know the current value of our goal, we need to calculate the future value of it considering inflation. Prices don’t remain the same as years pass by. You won’t be able to afford the same lifestyle with the same income for the next 10 or 20 years.

In ten years, a bottle of coffee may cost five times what it costs today. We need to inflate our goal amount to ensure that we have sufficient resources to realize our goals.

For our calculation purposes, we will consider the rate of inflation as 4.28% which is the current rate as of March 2018. You can also do a bit of research and use the rate at which you think prices will increase.

Formula to calculate the future value of our goal,

F = P x (1.043) n

Where, F = Future value in Rs.,

P = Present value in Rs.,

n = Number of years to achieve the goal.

So in the above case, the value of our car after 2 years will be approximately

F = Rs. 5,00,000 x (1.043)2

= Rs. 5,43,924.

Let us take another example. Mr. Ram wants to save for child’s higher education that presently costs Rs. 15 lakhs. He wants to achieve this goal within the next 20 years.

So in this case, the future value of his goal will be

F = Rs. 15,00,000 x (1.043)20

= Rs. 34,81,588.

Find out the SIP amount that should be invested in MFs to achieve that corpus after x no of years

It is important to have a realistic expectation with respect to the rate of returns from your investment. Although the stock market may have given returns above 50% in certain cases, it is not guaranteed that it will be able to replicate this performance every time. So it is best to have a modest expectation and take an average return of 12-15 percent while calculating our SIP amounts.

For calculating the SIP amount required to achieve the goal, we can make use of our very own Microsoft Excel. It provides an excellent formula to help us estimate this value.

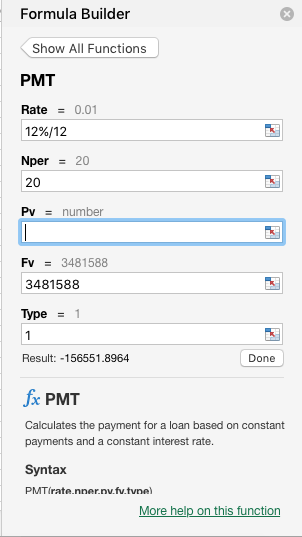

For this we will be using the in-built PMT formula in Excel. Hit on the function (fx) button and use the PMT formula. Fill in the following values.

Rate: This is the rate of return you are expecting. In this example we have used 12 per cent. Since you are investing via a monthly SIP, you will have to divide 12 per cent by 12 months, which will be 0.01 (12%/12).

Nper: This is your investment horizon of 10 years. Since you are making monthly investments you have to multiply it with months (10 years X 12months = 120)

Pv: Leave it blank as you are not investing any lump sum amount

FV: Enter the inflation-adjusted goal amount of Rs 21,58,925 we have calculated earlier.

Type: Assuming that you will be pay first SIP right away, enter the figure 1

The formula would give you Rs. 1,56,551.89. This is the monthly SIP you are required to create a corpus of Rs 34.81 lakh in 20 years. Provided it returns 12 per cent per year.

Divide that amount into 3-4 MFs and start SIPs in them

Now that we know the monthly SIP amount that we need to invest for achieving our goal, the next step is to identify a set of 3-4 equity mutual funds and then split the SIP amount uniformly across them. For this purpose, we can refer to Value Research Online tool. It is one of the best tools available in the market for researching on mutual funds.

Select a mixture of large-cap, mid-cap and multi-cap funds. A sample portfolio can contain the below funds:

- ICICI Prudential Value Discovery Fund

- SBI Blue Chip Fund

- Mirae Asset India Equity Fund

- L&T India Value Opportunities Fund.

But the above is just an example. It is by no means a recommendation to invest in these funds. Every investor should exercise his discretion or consult with a certified financial planner while choosing to invest in any fund.

It is best to have a maximum of 3-4 funds to diversify the investment to protect against market volatility. But over-diversification also dilutes the returns. So it is not suggested to have more than 4 funds in the portfolio.

Invest in direct plans of MFs to save on commissions and earn higher returns

While investing in mutual funds, it is always advisable to invest in direct plans than regular plans. By following this we can save a lot in the long term on commissions. In regular plans, stock advisors and brokers receive commissions from the fund’s NAV and hence the NAV automatically goes down. Since in the direct plan there are no such commissions, the investor can earn the entire amount which otherwise would have got deducted as commission. Hence the NAV for direct plans is also higher than regular plans.

Set up auto payments for registered billers

The investor will first need to register a SIP with a mutual fund company before he can start investing in the fund. I will write a separate article for the step by step guide on how to do that.

Once the URN is generated after SIP registration, he will need to add the biller in his net banking account. While setting up the biller, please remember to enable the auto-pay option. This will ensure that the SIP amount is automatically deducted from your account on a specified date. This way you will not have to remember the SIP date every month and manually pay the bill. This will help to avoid any misses as well.

With this, we are all set to start on our investing journey and achieve our goals. The sooner you start investing the better because you will allow your investments more time to grow. Please share your comments in the below section if you liked the article and found it helpful. May the force be with you !!