Contents

With the start of the new financial year, people are exploring various options to save on taxes. Under Sec 80C, the Government of India allows investments under various products for tax exemption. Some of them are PPF, ELSS (Equity linked savings scheme), PF, NPS, Senior Citizen Scheme etc.

What is ELSS?

ELSS or equity linked savings scheme is as the name suggests, an equity product. It is a diversified equity mutual fund that spreads the corpus across stocks of companies with varying market capitalizations. Under Sec 80 C, the money invested in ELSS funds is totally exempt from tax. They have a low lock-in-period of 3 years after which the whole money can be withdrawn. Any amount can be invested per annum but up to Rs.1.5 lakhs maximum is eligible for a tax deduction.

What is PPF?

PPF or Public Provident Fund is a tax saving investment that is backed by the Government of India. It has a lock-in period of 15 years and the interest is determined by the Ministry of Finance every quarter. The current rate of return from 1 January 2018 is 7.6%. Under Sec 80 C, the money invested in PPF is eligible for tax deduction. A minimum amount of Rs.500 and a maximum of Rs1.5 lakhs can be invested every year.

Comparison between the two

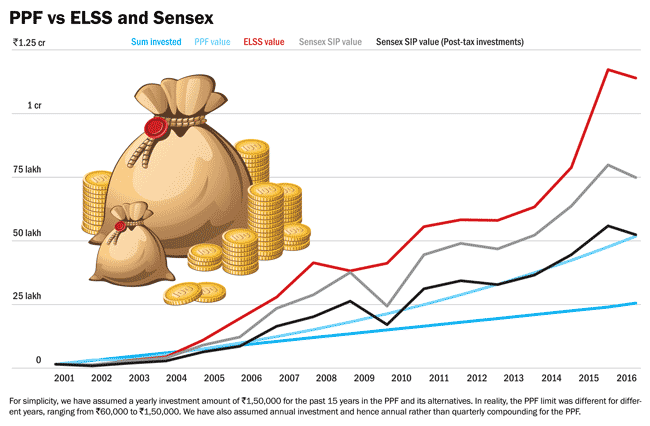

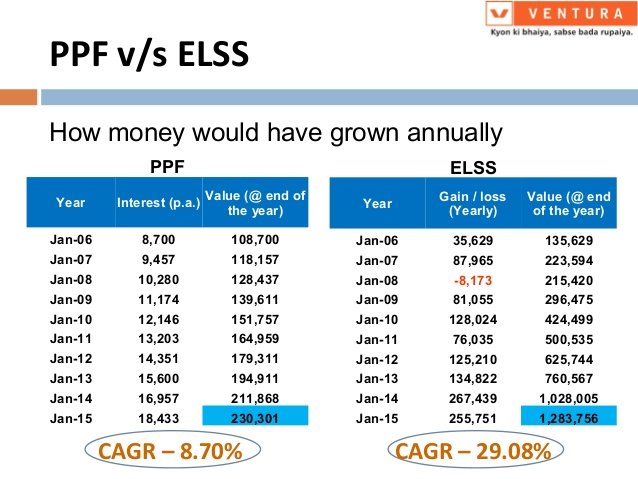

If invested systematically, ELSS schemes would yield higher returns as compared to fixed income products like PPF, national savings certificates or NFCs over the period of 15 years. However, the investment has to be done regularly through SIP instead of lumpsum to take advantage of rupee cost averaging.

We have to understand that investments in tax-saving instruments are not only to save tax but also for long term wealth creation. We are talking about Rs.1.5 lakhs of hard earned money invested every year. If an individual invests Rs.12500 every month in ELSS funds for 15 years then his investments would grow to Rs. 61 lakhs as compared to Rs.29 lakhs in PPF.

Risk tends to reduce as investment period increases

If investors are worried about risk then risk of losing money in equity decreases drastically over the long term. Tax-saving instruments are usually for the long term. Hence ELSS funds fit the bill. Moreover, ELSS will effectively be a tax-free investment (EEE).

Below is a quick overview of the pros and cons of investing in ELSS and PPF.

| Particulars | ELSS | PPF |

| Risk involved | Being an equity fund, the investments are subject to market risks | It is a safe option as it is guaranteed by the Government of India |

| Returns | Linked with the performance of the stock market. On average, an investor can expect to get 12-14% | Rate of interest is dynamic and decided by the Ministry of Finance every quarter. Presently it is 7.6% |

| Tax benefits | EEE (Exempt-Exempt-Exempt) The invested amount is exempt from taxes at the time of investment, accumulation, and withdrawal | EEE (Exempt-Exempt-Exempt) The invested amount is exempt from taxes at the time of investment, accumulation, and withdrawal |

| Lock-in period | 3 years | 15 years |

| The maximum duration of the investment | No limit | No limit (initial investment period is for 15 years after which it can be increased by blocks of 5 years) |

| The maximum amount of investment | No upper limit (however max 1.5 lakhs is eligible for tax deduction under Sec 80C) | Minimum investment of Rs.500 and a maximum investment of Rs.1.5 lakhs every financial year |

From the table above, it is clear that PPF is a relatively safer option but offers lower returns and longer time horizon as compared to ELSS. With the tax benefits being the same, ELSS certainly is a better tax-saving alternative to PPF (provided you have the appetite for market volatility).

You may also like:

Retirement Planning|Huge benefits of starting early in your 20s