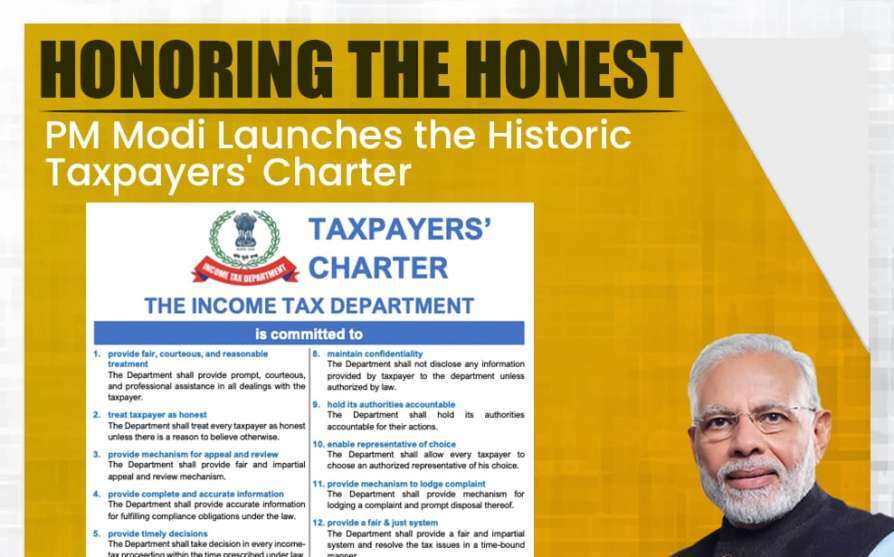

Prime Minster Narendra Modi on Thursday unveiled the taxpayers’ charter, which spells out the Income Tax (I-T) department’s commitments to taxpayers as well as expectations from them. Finance Minister Nirmala Sitharaman had announced that the charter was in the works during Union Budget 2020. Here are your key rights and duties under charter.

Income tax department’s commitments – and your rights

-Treat taxpayers as honest individuals and entities, unless there is a reason to suspect otherwise

-Provide fair and impartial mechanisms for review and appeal against (I-T department’s) decisions

-Respect taxpayers’ privacy and maintain confidentiality, refrain from intrusive inquiries or action

-Provide mechanism to taxpayers to lodge complaints and ensure prompt resolution

Tax-payers’ obligations under the charter

-Be honest and compliant, disclose complete information

-Be informed about tax rules and compliance requirements

-Maintain accurate records and documentation

-Respond in time to any queries raised

-Pay taxes and other dues on time

While the charter provides clarity to tax-payers on their rights and duties, it’s the implementation on the ground that will determine whether their lives will be simpler or not.

Also read: REITs-A good way to invest in real estate in 2020