Contents

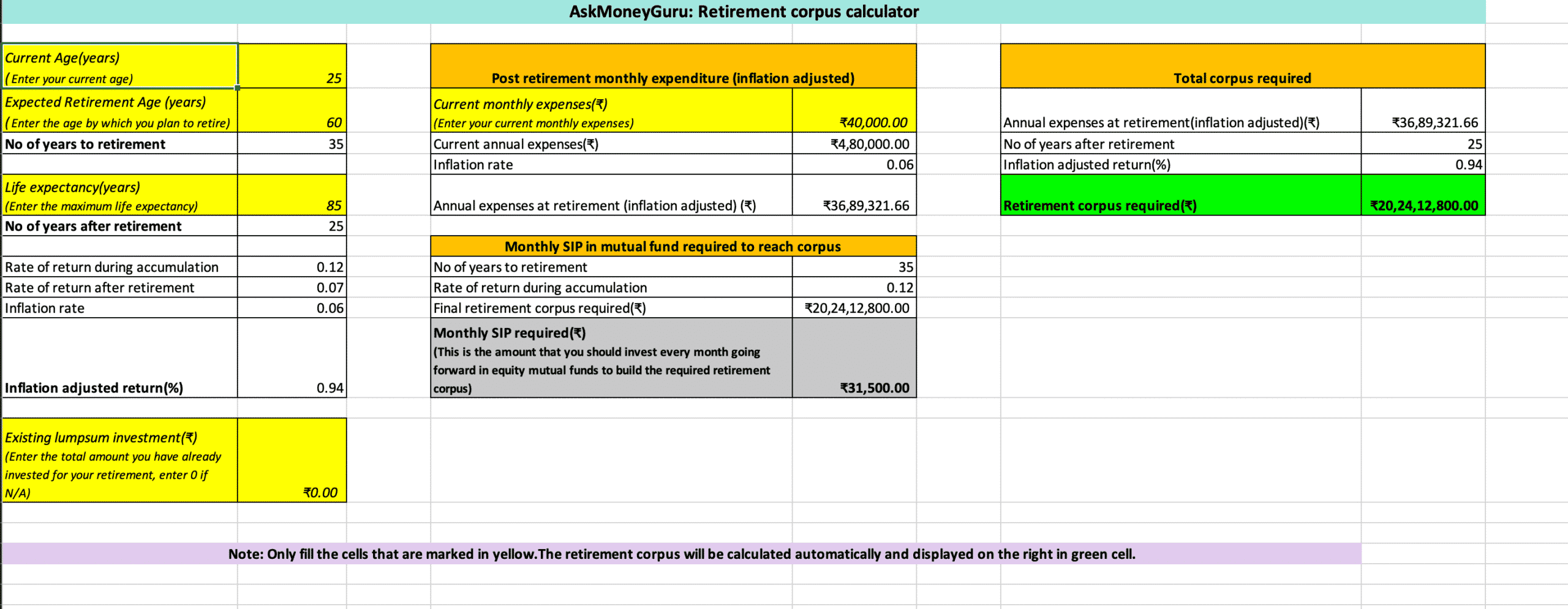

Dear reader, today I am going to explain to you the steps you can follow to use the very easy and highly useful retirement corpus calculator by AMG(AskMoneyGuru).

Purpose

The objective of this calculator is to give you a detailed and in-depth understanding of your post retirement expenses so that you can be prepared and plan for it in advance. Post retirement phase is a very important stage in everyone’s life. It is the culmination of all the hard work that a person has done for the last 30+ years during his/her prime years. It is the result of all the blood and sweat that a person has shed to achieve his/her goals. Hence it is crucial that after retirement, that person can enjoy his/her life to the fullest without having to financially depend on anyone else.

Read below to know more about why everyone should start planning for their retirement early,

Retirement Planning | Huge benefits of starting early in your 20s

Key terms and their meaning

Below are some of the key terms that have been used in this calculator and their meaning.

- Current age: This is your present age in years, e.g. 45

- Expected retirement age: This is the age by which you plan to retire, e.g. 60

- Number of years to retirement: Number of years left for retirement

- Rate of return during accumulation: This is the expected rate of return that your investments are expected to grow by each year annually(the default is considered as 12% assuming that you invest in equity mutual funds for your retirement)

- Rate of return after retirement: This is the rate of return that your investments will grow by post retirement(default is considered as 7% assuming that you invest in safe instruments such as bank fixed deposits, senior citizen scheme, etc.)

- Inflation rate: Annual rate of inflation in the economy(default is considered as 6%)

- Inflation adjusted return: Rate of return generated by your investments after adjusting for inflation

- Existing lumpsum investment: The amount you have already invested for your retirement

- Current monthly expenses: Your present total monthly expenses

- Current annual expenses: Your present total yearly expenses

- Annual expenses at retirement(inflation adjusted): Your predicted annual expenses post retirement after considering the inflation rate

- Retirement corpus required: The total sum that you need to accumulate in order to maintain your current lifestyle post retirement

- Monthly SIP required: The amount that you need to invest every month in equity mutual funds in order to build the retirement corpus.

How to use the retirement corpus calculator?

Using the calculator is very easy. As mentioned in the excel, you need to just fill in the values for the yellow cells and then let the calculator do its magic! Once you enter the values in the yellow cells, the retirement corpus required will be automatically calculated and displayed in the green cell in the right. You would also get an understanding of the monthly investment that you need to do in a good equity mutual fund in order to build that corpus. That monthly investment(SIP) will be displayed in the gray cell in the middle.

How to get the retirement corpus calculator?

Send an email to “askmoneyguru22@gmail.com” and I will help you out on the same.

Disclaimer: This should in no way be treated as investment advice. This is just to help the reader get an understanding and estimate of their post retirement requirements,