Contents

Don’t get tempted by the bitcoin frenzy

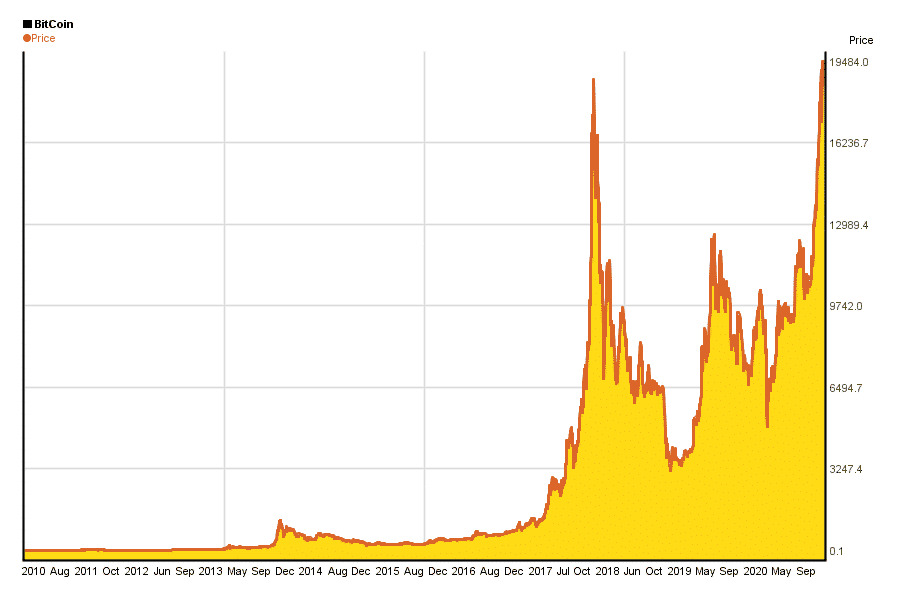

Bitcoin prices have surged more than 200% this year, taking it past $23,ooo for the first time. This increase can be largely attributed to how the cryptocurrency is designed and generated. There is only a finite supply that can be virtually “mined”. Every few years, the reward for miners is cut in half. This cuts in half the rate at which new Bitcoins are released and circulated. Knowing this should you be buying bitcoins as well?

This supply shock adds to the dwindling supply of bitcoins, which pushed its price upward. In May 2020, bitcoin witnessed the third halving of its lifetime, which is what has propelled the current mania.

What has stoked the rally further is the widespread participation of large institutions apart from retail investors. Limited in supply like gold, bitcoins are being seen as a protection against debasement in fiat currencies led by global central banks flooding the system with liquidity as part of massive stimulus measures. Unlike gold, the supply of bitcoin keeps shrinking, which is prompting some to even shift away from the yellow metal into the virtual currency as a better hedge.

Bitcoin price has been highly volatile

Multiple platforms offering easy access to the cryptocurrency digital marketplace are bound to increase. This was seen during the crypto-wave in 2017. Most of these platforms perished as the bitcoin bubble burst. Investing in bitcoins is convenient and cheap-the minimum ticket size is as low as Rs.100. However, investors should be aware of multiple red flags before considering this as an investment option.

First, there is no enforceable mechanism or backstop available in its current form. So if an investor is buying a bitcoin on a cryptocurrency exchange, there is no guarantee that the seller actually possesses the bitcoins he claims to have. There is no clearing and settlement system and hence the exchange cannot guarantee the settlement. While the Supreme Court in March 2020 made it clear that bitcoins are not illegal, there are no existing regulations to lend the asset legitimacy.

Further, bitcoins are plagued by high volatility. The price of bitcoins fell from over $18,ooo in December 2017 to around $3,200 in December 2018. Several investors got burnt badly. Besides, the increasing presence of cyber threats raises security concerns with cybercriminals out to scam cryptocurrency exchange users.