The credit score is an important metric used by lenders to evaluate a potential borrower’s creditworthiness.

TransUnion CIBIL is one of four credit rating agencies in India. Other bureaus include Experian, CRIF High Mark and Equifax.

Here is a look at the difference between Credit score and CIBIL, as per details available on the CIBIL website.

What is CIBIL?

TransUnion CIBIL Limited formerly known as Credit Information Bureau (India) Limited (CIBIL). It is a credit bureau or a credit rating agency which maintains the records of all the credit-related activities of companies as well as individuals including credit cards and loans.

According to the CIBIL website, “The bureau provides information and tools for gaining a clear understanding of their credit history and financial reputation, and guarding against the theft of personal information and potential fraud. For businesses, the bureau provide powerful information solutions, backed by professional service and current, comprehensive data, for making better, more informed decisions.”

“TransUnion acquired a 92.1 per cent stake in CIBIL,” as per the website.

What is CIBIL Score?

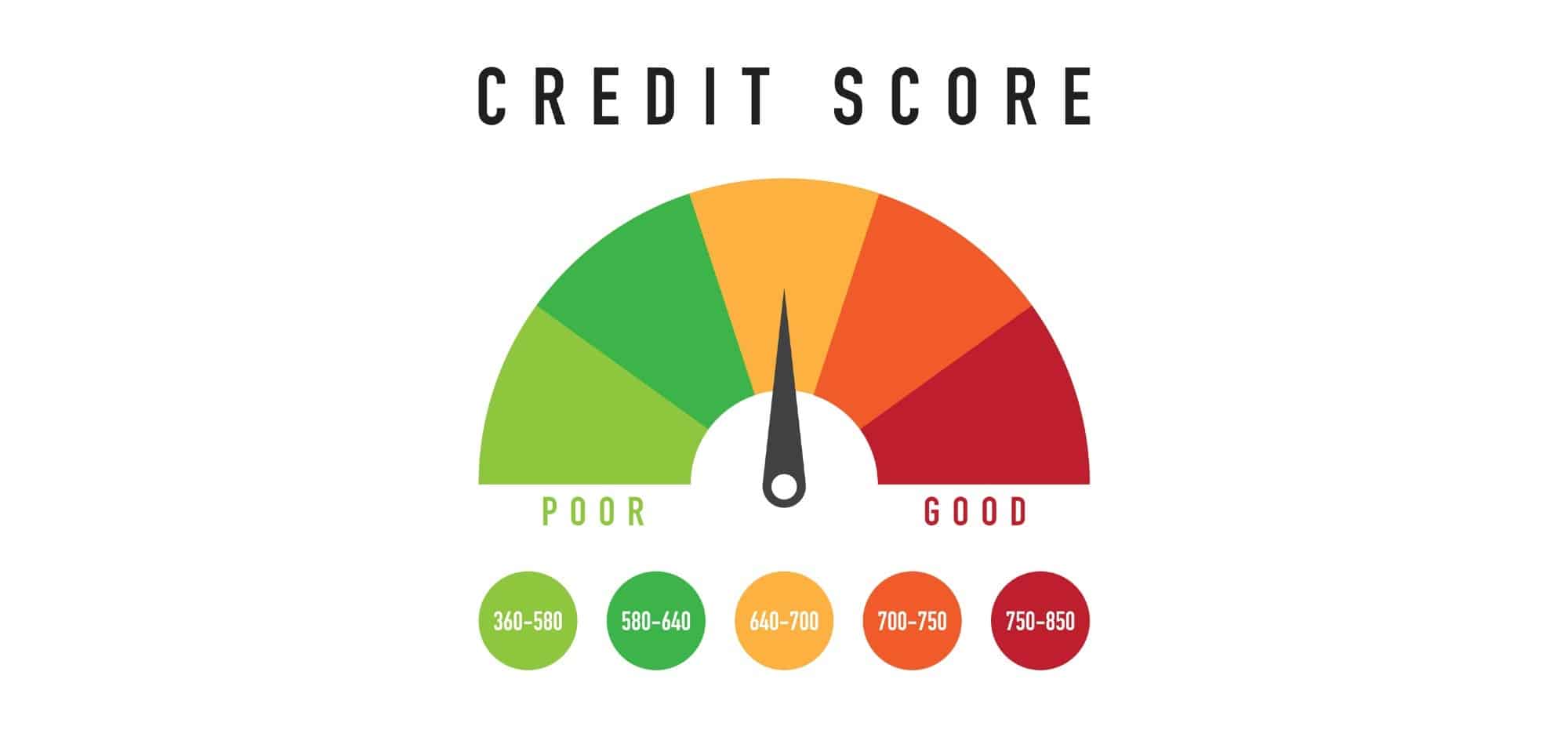

The CIBIL score is a three-digit numeric summary of a consumer’s credit history and a reflection of the person’s credit profile. The CIBIL Score ranges between 300 and 900. The closer a person’s CIBIL Score is to 900, the higher are the chances of the person’s credit card or loan application getting approved. According to the CIBIL website, any score greater than 750 is a good CIBIL Score and helps lenders in assessing and approving your loan application.

Also read: What is CIBIL Score?

The CIBIL Score is derived using the credit history found in the CIBIL Report or the Credit Information Report. It is basically a summary of your CIBIL Report, reflecting your credit worthiness.

How to check CIBIL Score?

Other than the CIBIL website, you can also check your credit score on websites of banking services aggregators.

On the CIBIL website to check your credit score you can either do it for free or access it by selecting a subscription plan. Using a free subscription, you can see your current CIBIL Report once in a year. CIBIL has paid plans which offer access to various additional features depending on the plan you choose.

What is a CIBIL Report?

The CIBIL Report (CIR) is an individual’s credit payment history across loan types and credit institutions over a period of time. However, a CIR does not contain details of your savings, investments or fixed deposits.

The CIBIL Report includes the consumer’s CIBIL Score and credit summary, personal information, contact information, employment information, and loan account information.

What information is available in the CIBIL Report?

The CIBIL Report generally has detailed information on the credit you have availed, such as home loan, auto loan, credit card, personal loan, overdraft facilities.

Other than the CIBIL Score, these are the key sections in the CIBIL Report, according to the CIBIL website.

Personal information: Contains your name, date of birth, gender and identification numbers such as PAN, passport number, voter’s number.

Contact information: Address and telephone numbers are provided in this section, up to four addresses are present.

Employment information: Monthly or annual income details as reported by banks and financial institutions.

Account information: This section contains the details of the credit facilities availed by you including name of lenders, type of credit facilities (home, auto, personal, overdraft, etc.), account numbers, ownership details, date opened, date of last payment, loan amount, current balance and a month on month record (of up to three years) of your payments.

Enquiry information: Every time you apply for a loan or credit card, the respective bank or financial institution accesses your CIR. The system makes a note of this in your credit history and the same is referred as “Enquiries”