Contents

Do you want to invest in stocks like Google,Microsoft,Facebook and Tesla? Do you wish to earn great returns from Apple stocks but not sure how to do it from India? Well, think no more.

Vested has come up with a unique solution to enable Indian investors to invest in US stocks and ETFs from the comfort of their homes.

Why should you invest in the US market?

Superior returns compared to India

The US market has consistently outperformed the Indian market over the last 10 years. In Figure 1, we compare returns of the DOW Jones Index in the US to the BSE Sensex. During this time period, the DOW returned 196%, while the SENSEX returned 150%.

Figure 1: Returns comparison between the Dow Jones index vs. the Sensex.

In addition to equity returns, the savvy investor should also think about the effect of currency fluctuations between INR and USD. In the past 10 years, the Rupee has depreciated 44% compared to the USD. This has a significant negative impact towards returns of Indian stocks widening the performance gap.

Figure 2: INR to USD exchange rate from the last decade – INR has depreciated by more than 44% in the past decade.

Exposure to other markets

Investing in the US can be an easy way to invest in other international markets. For example, you can easily invest in the Chinese economy through investing in the US market. The fast growing Chinese economy – driven by a growing middle class and rapid technology adoption – has led to the creation of some of the world’s leading technology companies. However, instead of going public in China, more and more of these Chinese technology companies are choosing to list in the US.

Figure 3: IPOs of Chinese companies in the US.

For Indian investors, another benefit of investing through the US stock market is that the ecosystem is very well regulated, with strict controls on financial reporting, transparency, and standardised governance practices, making it easier for the investors to evaluate the different opportunities. To learn more about this, you can read more here.

You can Invest in MNCs directly rather than the local Indian subsidiary

Many investors living in India invest in international MNCs because they assume there is a higher level of governance, technological proficiency and transparency in MNCs. However, investing in Indian subsidiaries is often a more expensive proposition. We studied 16 MNCs that are traded in reputable US exchanges and that have Indian subsidiaries that are also publicly traded in India.

On average, investors from India are paying ~3X higher multiples (P/E trailing twelve months) when investing in the Indian subsidiaries vs. investing directly in the parent company in the US. And despite paying significantly higher multiples, the average returns can be similar. The average 2019 returns of the US parent companies was ~14% (blue line in Figure 4), while the average returns of the Indian subsidiaries was ~17% (orange line in Figure 4).

Figure 4: Average 1 year return of US parent companies (blue) vs. Indian subsidiaries (orange). The grey lines represent the returns of the individual entities over the past year.

Who is Vested?

Vested is a US Securities and Exchange Commission Registered Investment Adviser (see risk disclosure). You can view their registration here. Their online platform enables investors from India to invest in US stocks and ETFs easily.

Attractive features offered by Vested

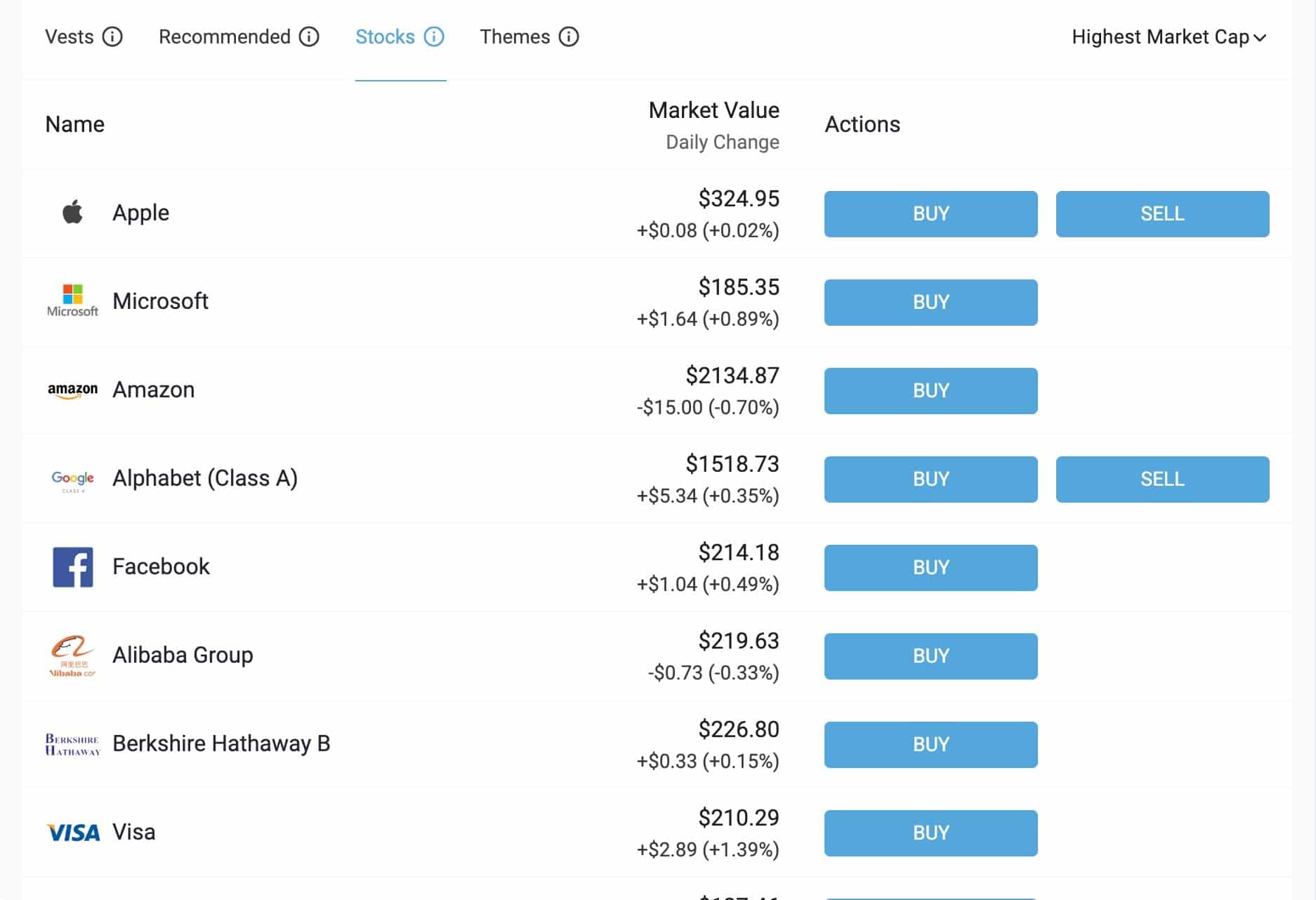

With Vested, you can purchase fractional shares of US companies. For example, let’s say that an Apple share costs $200 and you have 10$ in your account. Then you can buy 10/200 = 0.05 shares of Apple. This is a unique feature offered by Vested and one that enables investors to easily purchase shares of any of their dream companies even if they don’t have the sufficient funds. When the company declares a dividend, it will be shared with you in proportion to the number of fractional shares held by you. So if Apple declared a dividend of $5 per share, in the above case you will receive $0.25.

Zero commission

Unlike most brokerage firms, Vested does not charge any brokerage fees for any transaction. So you can place unlimited buy/sell orders on Vested platform but you will not be charged a penny. This can lead to a lot of savings in the long term.

No minimum balance

Vested does not require you to maintain a minimum balance in your account.

No account opening fee

You can create a new account in minutes for free(for a limited time only).

Vests

Vests are curated portfolios that comprised of stocks and/or ETFs. Vests are constructed with different goals or themes in mind. Some Vests are built to enable investors to invest into diversified core assets that balance performance and downside protection, while other Vests are theme based, enabling investors to narrowly focus their investments on specific industries or core themes.

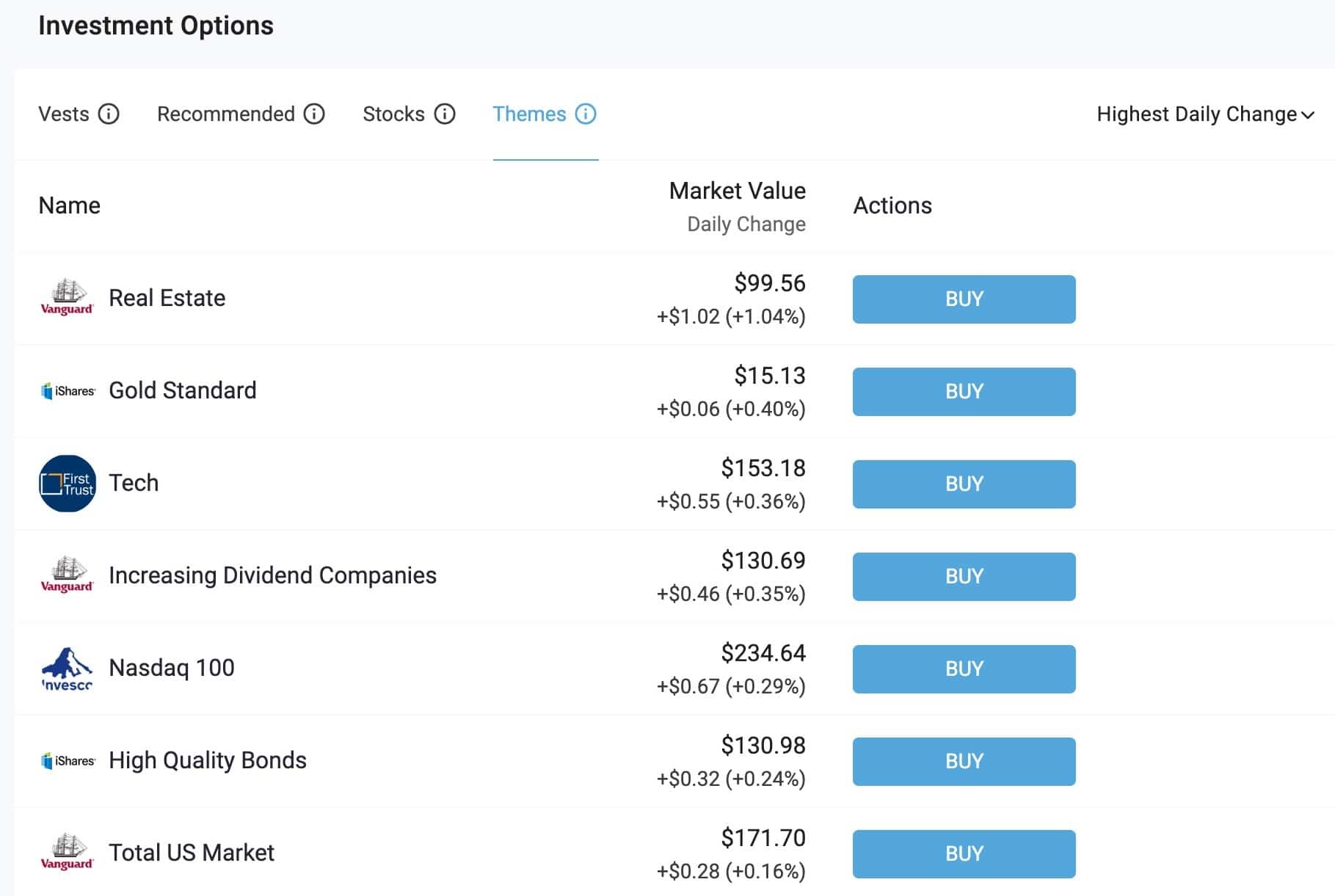

Themes

Vested’s Themes are selected to cover a broad range of sectors and risk profiles. Each Theme is an ETF that invests 80% of its assets in the type of investment or industry suggested by the name. Through this feature, you can invest in ETFs of other emerging markets such as China as well.

How much can you invest in US?

Instituted by the RBI, the LRS is a set of policies that governs the maximum amount and purposes of remittance. Under the LRS, an individual can annually send up to USD $250,000 abroad without seeking approval from the RBI. The LRS has made it easier for Indian residents to study abroad, travel, and make investments in other countries. For more information, you can read more here.

How to invest through Vested?

Now that you know that it is possible to invest in US and other international markets from India through Vested, the next step is to find out how to do it.

The process is very simple. You will have to first head over to the Vested home page and sign up for a free account. Once that is done, you will have to fund your Vested account.

Investments in US equities must be made in USD. You must wire (remit) USD to Vested’s partner bank in the US to fund your account. In order to do this, you must fill out an LRS form (it’s called the A2 form) and submit it to your bank. Do not worry! Vested makes this process easy for you. When you sign up on their platform, they will guide you through this process.

Once your account is funded, you can browse through the list of stocks/ETFs/vests listed on the platform and make your choice. Happy investing!