Contents

What is investment banking?

Investment banking is the division of a bank or a financial institution that provides underwriting, M&A and other financial advisory services to governments, corporations and institutions. It acts as the middle man between investors and companies (who are looking for capital to fund and grow their business). Investment banking jobs are one of the highest paid jobs in the world.

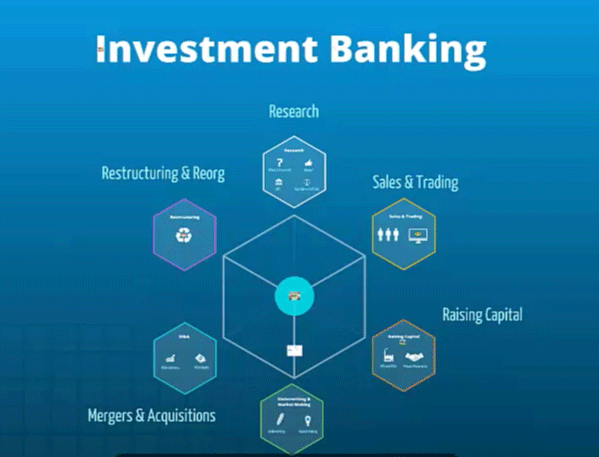

Services offered by investment banks

Full-service investment banks in India and abroad offer a wide range of financial services that can be broadly categorised as:

- Underwriting

Underwriting or capital raising is one of the primary services offered by investment banks in India and abroad. It helps corporations to go public and raise capital through the issuance of IPO, stocks and bonds to investors. Investment banks help to market the company and its products to potential investors. In return they charge a commission on each sale of stock or bond from the company.

- Mergers & Acquisitions (M&A):

Investment banking companies also help in the buying and selling of businesses. These companies use their extensive networks to help their clients find the best buying/selling opportunities.

- Sales & Trading

These banks help to match buyers and sellers of securities in the secondary market.

- Equity Research

Investment banks do a comprehensive market study and come up with detailed reports/analysis for various companies. Based on such reports, investors can make informed decisions on the stocks that they want to buy or sell.

- Asset Management

They also help to manage the investment portfolio for a wide range of investors including institutions and individuals.

Skills required in investment banking

Investment bankers are expected to have a niche set of skills that include financial modeling and valuation, pitchbook presentations, negotiation skills, excel building skills, etc.

Below is the list of skills that are required for an investment banking professional:

- Financial modelling

Performing a wide range of financial modeling activities such as building 3-statement models, discounted cash flow (DCF) models, LBO models, and other types of financial models.

- Business valuation

Using a wide range of valuation methods such as comparable company analysis, precedent transactions, and DCF analysis.

- Pitchbooks and presentations

Building pitchbooks and PPT presentations from scratch to pitch ideas to prospective clients and win new business.

- Transaction documents

Preparing documents such as a confidential information memorandum (CIM), investment teaser, term sheet, confidentiality agreement, building a data room, and much more.

- Relationship management

Working with existing clients to successfully close a deal and make sure clients are happy with the service being provided.

- Sales and business development

Constantly meeting with prospective clients to pitch them ideas, offer them support in their work, and provide value-added advice that will ultimately win new business.

- Negotiation

Being a major factor in the negotiation tactics between buyers and sellers in a transaction and helping clients maximize value creation.

Investment banking companies

Below is the list of top 100 investment banks in the world:

- ABN AMRO

- Allahabad Bank

- Allen & Company

- Bank of America Merrill Lynch (BAML)

- Barclays Capital

- BB&T

- BBY Ltd.

- Berkery, Noyes & Co.

- BG Capital

- Blackstone

- BMO Capital Markets

- BNP Paribas

- Cantor Fitzgerald

- Capstone Partners

- Centerview Partners

- China International Capital Corporation

- CIBC World Markets

- Citi

- CITIC Securities International

- CLSA

- Commerzbank

- Corporate Finance Associates

- Cowen

- Credit Agricole CIB

- Credit Suisse

- CSG Partners

- Daewoo Securities

- Deutsche Bank

- Duff & Phelps

- Europa Partners

- Evercore Partners

- Financo

- Gleacher & Company

- Goldman Sachs

- Greenhill & Co.

- Guggenheim Partners

- Guosen Partners

- Houlihan Lokey

- HSBC Holdings PLC

- Imperial Capital

- ICBC (China)

- ICICI Bank

- Indian Bank

- J.P. Morgan

- Jefferies & Co.

- Keefe, Bruyette, & Woods

- KeyCorp (KeyBanc Capital Markets)

- Ladenburg Thalmann

- Lancaster Pollard

- Lazard

- Lincoln International

- Macquarie Group

- Maple Capital Advisors

- Marathon Capital

- McColl Partners

- Mediobanca

- Miller Buckfire & Co.

- Mitsubishi UFJ Financial Group

- Mizuho Financial Group

- Moelis & Company

- Montgomery & Co.

- Morgan Keegan & Co.

- Morgan Stanley

- Needham & Co.

- NBF (National Bank Financial)

- Nomura Holdings

- Oppenheimer & Co.

- Panmure Gordon

- Perella Weinberg Partners

- Piper Jaffray

- PNC Financial Services (Harris Williams & Co.

- Punjab National Bank

- Raymond James

- RBC Capital Markets

- RBS

- Robert W. Baird

- Roth Capital Partners

- Rothschild

- Sagent Advisors

- Sandler O’Neill Partners

- SBI Capital Markets (State Bank of India)

- Scotiabank

- Societe Generale

- Sonenshine Partners

- Stephens, Inc.

- Stifel Financial

- Sucsy, Fischer & Company

- Sumitomo Mitsui Financial Group

- SunTrust (Robinson Humphrey)

- Syndicate Bank

- TD Securities

- United bank of India

- UBS

- Vermillion Partners

- Vijaya Bank

- Wedbush Securities

- Wells Fargo & Co.

- William Blair & Company

- WR Hambrecht & Co.

- Yes Bank.

Investment banks in India

In India, below is the list of top 10 investment banks that provide financial advisory services to clients:

- Bank of America

- Barclays Capital

- N.P. Paribas

- Citi Bank

- Credit Suisse A.G.

- Deutsche Bank

- P. Morgan

- Kotak Mahindra Bank Limited

- The Hongkong and Shanghai Banking Corporation Limited

- Yes Bank Limited.

Investment banking courses

Below are some of the popular investment banking courses that can help to get a job in one of the top firms:

This is a certification course offered by the National Stock Exchange of India (NSE). The course will cost approximately Rs. 1700. After purchasing the course, you can download the course content in pdf format. You will also be able to download some sample question papers for preparation. You can search online for question papers of previous years. The exams are easy to clear. They have courses on Mergers & Acquisitions, NSE, etc.

The content of this course is designed by a senior Private Equity Professional. It covers the entire Private Equity life cycle. It also has an overview of M&A and a separate chapter on Project Finance. At the end of the course, you will be awarded with an industry recognized FLIP certification.

This is one of the top investment banking courses offered by Flip. It focuses on Fundamental Analysis, Financial Modeling and Valuations. At the end of the course you will be awarded with a FLIP NCFM certification issued by the NSE Academy Ltd. This course is extremely helpful for candidates looking to ace the Research Analyst interview.

This course is divided into 2 parts:

- A FLIP NCFM certification issued by the NSE Academy Limited on issue management

- FLIP certification on Private Equity and Mergers & Acquisitions.

As mentioned above, investment banking professionals need to prepare multiple reports and presentations for their clients. This is a part of their routine jobs. Hence Excel and PowerPoint are two of the must have skills for an investment banker.

This online course will ensure that you gain a mastery over both of them. Learn from scratch, how to use Excel – manage data, use formulae, and present data effectively. It also covers functions like Goal seek, H-Lookup, V-Lookup, Pivot Table, essential for analysis and reports. It has special focus on finance related functions like PV, FV, NPV, IRR, through real-life examples. PowerPoint [2007 and 2010] – Learn about important PowerPoint features. Then, via real life examples, use these features to create an effective presentation, for projects and client presentations.

If you are looking for in-depth knowledge about the complex world of technical analysis then this course is perfect for you. It covers chart patterns and indicators such as RSI, Fibonacci and Moving averages. A must for every aspiring or new equities or currencies trader in financial markets.

This course covers a wide range of topics including Investment banking operations in international markets. It includes the trade life cycle of equities, fixed income, foreign exchange, structured products and derivatives.

This course covers Equities – IPOs and FPOs, Bonds, CPs and FCCBs. It takes you step by step through the process, with timelines and the regulatory requirements.

Investment banking interview questions

For sample interview questions on a variety of topics such as Accounting, Corporate Finance, Valuation, M&A, etc. refer to the below guide,

https://www.wallstreetmojo.com/investment-banking-interview-questions/

It contains a question bank of some common questions asked in interviews.