The thought of premature retirement brings in concerns of how to build an early corpus that is enough to provide for the longer retirement years ahead. And if you plan to hang your boots in your 40s, the years to build the corpus will be short.

Wondering whether it is a realistic thought to retire in your 40s with a corpus that can provide you with a decent lifestyle? The two main questions that come up are: Have I saved enough so I can live off my investment returns every year? How much do I need to retire early? How long do I need my money to last?

If you plan your investments well, you can get decent regular income even if you retire in your 40s.

Recommended reads: Retirement Planning|Why do you need to start early in your 20s?

Let’s assume you are a 25-year-old earning Rs 40,000 per month. Here’s how to save and invest to reach your goal of a big corpus at age 45:

Year 1: Save Rs. 12,000 each month and invest it in a set of well-diversified equity funds. Equity funds historically return a long-term average return of 14-16%. We will assume 14% for this plan.

Year 2: Increase your investments by 10% to Rs. 13,200 per month. This is not too difficult because you can expect your salary to increase by 8-10% every year!

Years 3-20: Repeat the 10% increase every year in line with your salary increase and stay invested in good equity funds. During this period, you will probably encounter 3 or 4 market storms when it would seem that things are taking a turn for the worse. Stay the course.

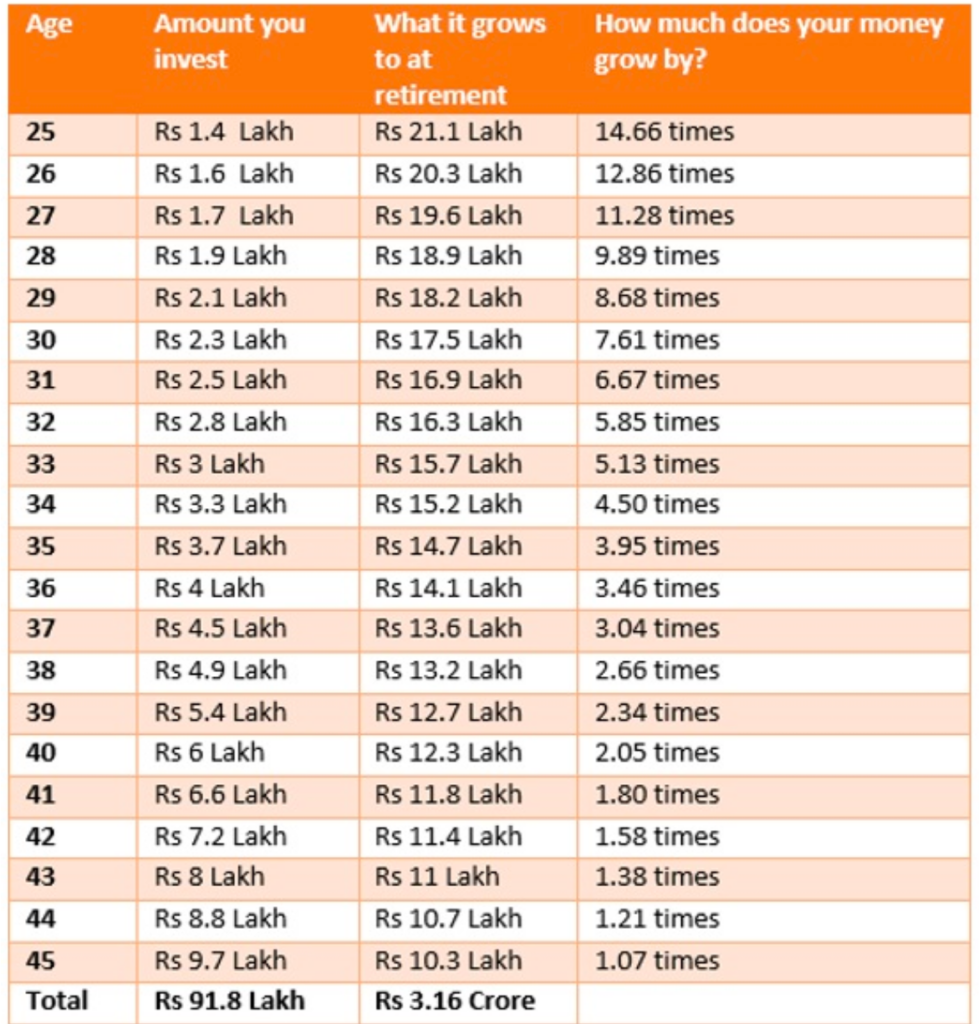

That’s it. Here is the supporting calculation:

*Equity growth is illustrative. It will never grow at a steady pace as shown. Markets tend to fluctuate and you will see large ups and downs.

If everything goes according to plan (there is a possibility that it may not, more on that later), in 20 years, you would have accumulated Rs 3 Crore plus. That sounds like a lot of money by saving only Rs. 12,000 per month! In fact, you would have contributed only about Rs 90 lakhs of this. The rest comes from that magical thing called compounded return. It’s good to have a friend like that working for you!

Now for the regular income.

By the time you get to this point, your expenses would have gone up too and you would need about Rs. 1.3 lakhs per month to meet your expenses. Here’s what you would do now:

Step 1. Take 5 years’ worth of expenses (Rs 80 lakhs) and put that into a debt/liquid fund. Keep drawing it every month for your expenses. (Technically it’s not really “Salary”, but really?)

Step 2. Let the rest remain in equity funds so your friend – compounded return – keeps working for you.

Step 3. At the end of every 5 years, take 5 years’ worth of expenses from the equity funds and add to your debt funds

Step 4. You are all set for the next 50 years. Now, go change the world with that brilliant mind of yours!

By the way, what you did above is called an “income ladder” and is an awesome way to generate inflation-protected income when you stop earning. Aren’t you feeling really smart now!