What is a good amount to start investing in mutual funds? How much should be sufficient? These are some of the common questions asked by people when they start mutual fund investment. It usually depends on the financial goal that the person is saving for. And the time period for which he is planning to invest.

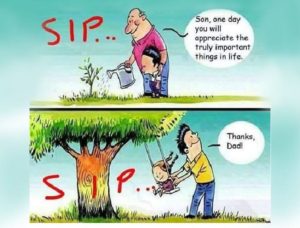

Most of the mutual fund companies have a minimum SIP limit of Rs.500. So that means that if anyone wants to invest in that fund through SIP then he has to put in minimum Rs.500 every month. As mentioned above, the SIP amount depends on the goal that the person is investing for and his investment tenure. But as a starting point, beginners can start small and keep it increasing it gradually from time to time. He should top up the SIP every year in par with the rise in income. For example, if in a year he received 10% hike in salary then he should also increase his SIP amount by 10%. Likewise, he should keep increasing it every year.

A modest SIP of Rs.2000 for 30 years can make you a Crorepati. Below table shows an illustration of the final returns of SIP investments ranging from Rs.1000-5000 for 25 years at 12% rate of return (average return of equities),

| Sl. No. | SIP amount(in Rs.) | Tenure(in years) | Total amount invested(in Rs.) | Final value of investment(in Rs.) | Total gains(in Rs.) |

| 1 | 1000 | 25 | 3,00,000 | 18,97,635 | 15,97,635 |

| 2 | 2000 | 25 | 6,00,000 | 37,95,270 | 31,95,270 |

| 3 | 3000 | 25 | 9,00,000 | 56,92,904 | 47,92,904 |

| 4 | 4000 | 25 | 12,00,000 | 75,90,540 | 53,90,540 |

| 5 | 5000 | 25 | 15,00,000 | 94,88,176 | 79,88,176 |

Had the SIPs been increased by 10% every year,

| Sl. No. | SIP amount(in Rs.) | Tenure(in years) | Total amount invested(in Rs.) | Final value of investment(in Rs.) | Total gains(in Rs.) |

| 1 | 1000 | 25 | 6,60,000 | 31,41,398 | 24,81,398 |

| 2 | 2000 | 25 | 13,20,000 | 62,82,796 | 49,62,796 |

| 3 | 3000 | 25 | 19,80,000 | 94,24,190 | 74,44,190 |

| 4 | 4000 | 25 | 26,40,000 | 1,25,65,591 | 99,25,591 |

| 5 | 5000 | 25 | 33,00,000 | 1,57,06,988 | 1,24,06,988 |

This is the power of compounding. A modest investment of Rs.4000 per month can make you a Crorepati over a span of 25 years!! That’s simply mind-blowing.

You may also like: How to plan for financial goals and how to invest to achieve them?

Simply investing in mutual funds is not enough. That is only the first step, the next step is to review the performance of the portfolio periodically. This should be done at least once a year. For this purpose, we can make use of readymade tools like Value Research. Value Research is an online encyclopedia of mutual funds. It tracks all the nitty gritties of the Indian mutual fund market and is the best tool available for mutual fund research online. You can register for free in their portal and build a portfolio. There you can mention all the funds that you have invested in.

Value Research will then show you the performance of those funds compared to the Nifty and also show a rating for it. If you find that your fund is consistently delivering returns below Nifty for two consecutive years then it is time to change your fund. You should exit from the low performer and switch to a better one.

Last but not the least investing in mutual funds is a game of patience. There is no such thing as getting rich quick. People who have fallen for this trap have repeatedly lost millions overnight. Always aim for the long term, at least 20 years and keep investing religiously without any break. The market rewards those who have the patience and the discipline to keep investing regularly over a long period. As the saying goes, “Patience is the key to success”. This holds true for mutual fund investments as well.